Sasseur REIT – Riding on Robust Consumption

traderhub8

Publish date: Mon, 05 Jun 2023, 10:48 AM

- 1Q23 tenant sales jumped 17.9% YoY. We expect FY23e tenant sales to rise by 25% given the re-opening in China, 18 days of closure a year ago and the shift in consumption towards bargains in outlet malls. 1Q23 DPU of 1.849 cents was highest since listing.

- Stable income base guaranteed by the sponsor with 3% annual rental escalation provides a cushion 5.4% dividend yield from this fixed component alone. Potential accretive acquisition of Xi’an asset drive DPU up by 4%.

- We initiate coverage with a BUY recommendation on Sasseur REIT and a DDM-based target price of S$0.90. Accretive inorganic growth, the better-than-expected tenant sales growth are potential re-rating catalyst and attractive yield of 8.7% paid quarterly.

- 1Q23 tenant sales jumped 17.9% YoY. We expect FY23e tenant sales to rise by 25% given the re-opening in China, 18 days of closure a year ago and the shift in consumption towards bargains in outlet malls. 1Q23 DPU of 1.849 cents was highest since listing.

- Stable income base guaranteed by the sponsor with 3% annual rental escalation provides a cushion 5.4% dividend yield from this fixed component alone. Potential accretive acquisition of Xi’an asset drive DPU up by 4%.

- We initiate coverage with a BUY recommendation on Sasseur REIT and a DDM-based target price of S$0.90. Accretive inorganic growth, the better-than-expected tenant sales growth are potential re-rating catalyst and attractive yield of 8.7% paid quarterly.

Company Background

Sasseur REIT (SASSR) is the first outlet mall REIT listed in Asia. It owns four assets located in Chongqing Liangjiang and Bishan, Hefei, and Kunming, riding on China’s recovery in consumer spending. There has been a shift in consumer preferences towards bargain purchases and a greater emphasis on product brands and quality.

SASSR has a diversified tenant mix, with domestic fashion brands contributing to 43.2% of the total sales. International luxury brands such as Gucci, Coach, Armani, and Michael Kors accounted for 19.1%; and sports accounted for 18.2% as at Mar23. These brands have long been favoured by Chinese consumers and have demonstrated a stable performance.

Key Investment Merits

- Riding on robust consumption in China. Tenant sales at the portfolio level was up 17.9% YoY in 1Q23 (+7.1% 1Q19) due to pent-up demand and successful promotional events. Outlet malls are capitalizing on the shift in consumer preference that is becoming more budget-conscious. There is a price control agreement with tenants. Off-season must be 20-30% cheaper than retail and in-season at least 10% discount. Leveraging on the increasing popularity of the outlet mall concept, tenant sales pre-COVID were already growing at 12% YoY in FY19. With the normalization post COVID and pick-up in consumption, sales in FY23e are expected to increase by 25%.

- Stable rental income base. SASSR has mitigated operational risk through the EMA rental income model, which comprises a fixed component guaranteed by the sponsor and a variable component generated from tenant sales. The sponsor bears all operating expenses and is liable for a 3% annual rental escalation. FY23e is estimated to register dividend yield of 5.4% from the fixed component alone.

- Attractive yield and potential inorganic growth. SASSR is focused on expanding its portfolio through strategic acquisitions of retail outlet malls. The Xian and Guiyang assets have been granted the Right of First Refusal (ROFR) by the sponsor. With a gearing assumption of 50%, SASSR currently has a debt headroom of S$861.2m. The valuation of the Xi’an asset is estimated to be around S$500mn-600mn, with a stable cap rate of c.7%. We believe such an acquisition is DPU accretive with a positive carry of 1.5% and would raise it by 4% given that EMA rental income would increase by 45%.

We initiate coverage with a BUY rating and a target price of S$0.90 based on DDM valuation, COE of 9.15% and terminal growth of 1.5%. We expect DPU of 6.55 cents for FY23e and 6.68 cents for FY24e, translating into yields of 8.7% and 8.9%, respectively.

Revenue

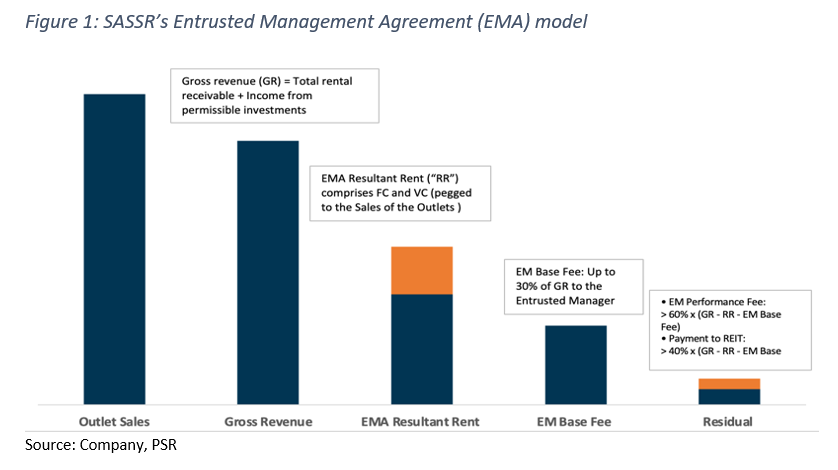

EMA Model: The Group receives EMA rental income under the Entrusted Management Agreement (EMA), which provides downside protection by the sponsor through an annual fixed rental. Additionally, the Group can benefit from the upside through tenant’s performance by receiving a variable component.

The fixed component for each property is subject to an annual escalation rate of 3.0%, aligning with projected inflationary trends. The variable component varies across different malls (Figure 2): (i) Chongqing outlet mall is calculated as 4% of the retail sales; (ii) Bishan outlet mall is at 4.5%; (iii) Hefei outlet mall is at 5.5%; (iv) Kunming outlet mall is at 5%. In FY22, the combined variable component accounted for 27% of the total EMA rental income (Figure 3).

The EMA has a term of 10 years from the Listing Date, with five years remaining. The underlying rental structure for tenants is similar to Singapore mall REITs, which is a combination of fixed rental and turnover.

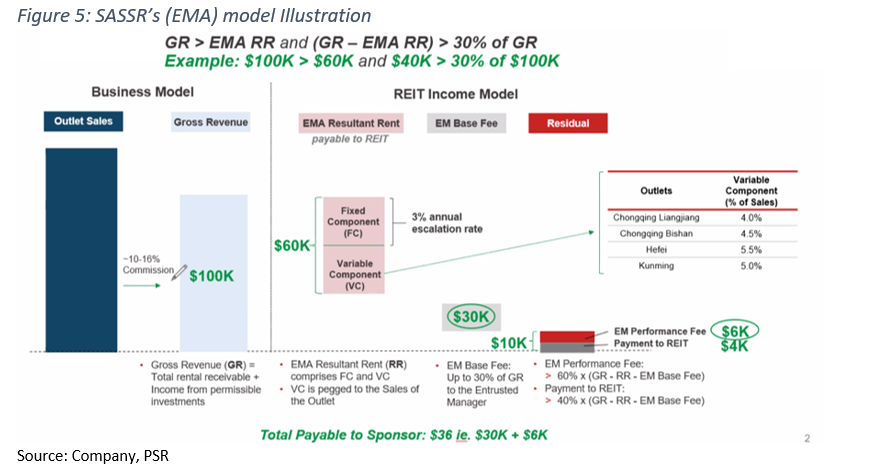

An example of the EMA

If the Gross Revenue (GR) is greater than the EMA Resultant Rent (EMA RR) and the difference between GR and EMA RR exceeds 30% of GR, the REIT manager is entitled to EM Base fee and Residuals.

For instance (Figure 5), if the Gross Revenue is S$100,000 and the EMA RR is S$60,000, which satisfies the first part of the condition (GR > EMA RR), the difference between GR and EMRR is S$40,000. This difference is then compared to 30% of GR, which is S$30,000 in this case. Since S$40,000 > S$30,000, the condition is met. The Gross Revenue is S$100,000, while the EMA RR stands at S$60,000. The EM base fee is S$30,000. Performance fee amounts to S$6,000 and payment to the REIT would be S$4,000.

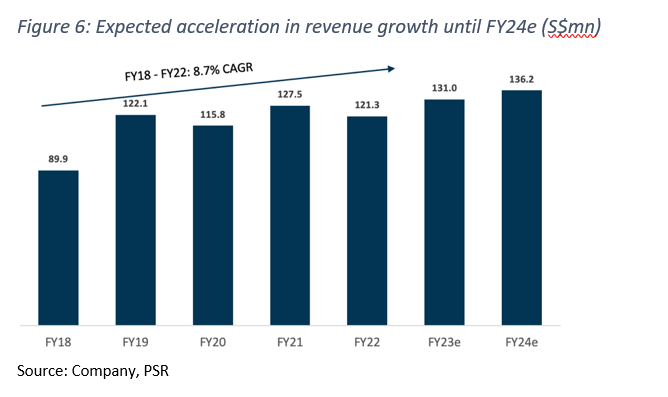

Revenue Growth

We expect revenue growth of 4% YoY for FY23e to $131mn (+11% pre-COVID level) as a result of fixed annual rental escalation of 3% and the increased sales from the outlets. SASSR has been leveraging emerging consumer trends, such as outdoor leisure and micro-vacations, to continuously refine the tenant mix and attract new customers. With VIP membership surpassing 3mn in 1Q23, and Liangjiang accounting for a third of these members, SASSR is enhancing the VIP experience by upgrading the VIP lounge in Chongqing Liangjiang and introducing more promotional activities to drive sales.

Source: Phillip Capital Research - 5 Jun 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024