Singapore Telecommunications Ltd – Pulled Down Under

traderhub8

Publish date: Mon, 29 May 2023, 06:10 PM

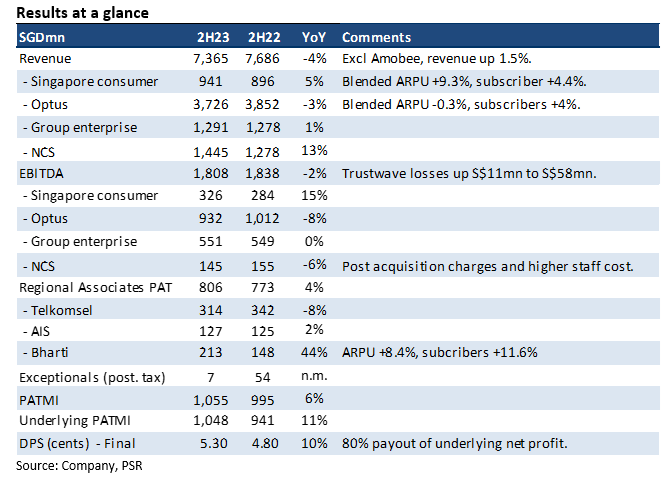

- FY23 revenue met our expectations at 103% of FY23e estimates. EBITDA was 96% of estimates. Australian dollar weakness of 7.4% YoY in 2H23 was a major drag to earnings.

- 2H23 underlying PATMI grew 11% to S$1.05bn. Almost all the growth came from lower depreciation and amortisation of S$90mn. Optus remains the major drag in earnings with its paltry ROIC of ~2% and 2H23 net profit of only A$7mn.

- We left our FY24e revenue and EBITDA relatively unchanged. Our SOTP TP of S$2.84 and ACCUMULATE recommendation is maintained. Capital management remains the largest upside with planned capital recycling of S$6bn, including disposal of Trustwave, redevelopment of Comcentre and partial monetisation of infrastructure assets (datacentre, satellite, submarine cable). Any longer-term re-rating and improvement in ROIC will include a more significant return to profitability for Optus.

The Positives

+ Re-opening boost for Singapore mobile. Mobile service revenue increased 13% YoY to S$431mn from higher ARPU (+9%) and subscribers (4%). Increased travel boosted the lucrative roaming revenue. There is further room to recover as current roaming is 60% of pre-pandemic levels. Another initiative to boost ARPU is to remove the lowest-tier pricing plans.

+ Continued strength in Bharti earnings. Earnings contribution from Bharti rose 44% YoY to S$213mn. Earnings benefited from higher ARPU (+8% YoY), increased data usage and strong 4G subscribers (+12%). However, the pace of growth should stabilise as ARPU is flat QoQ at Rp193.

The Negative

– Challenging profitability at Optus. Excluding the one-off NBN migration revenue, 2H23 EBITDA is up 1.6% YoY to A$1bn. Bulk of the revenue growth in 2H23 was from low margin equipment sales that rose 16% to A$839mn. We believe Optus is struggling to achieve any economies of scale. Indirect (non-revenue related) cost is rising in line with service revenues. The A$4.5bn of capex over the past three years has so far not generated much additional growth in revenue, in our opinion*. Meanwhile, depreciation and interest expenses are stubbornly high despite the de-gearing exercise from the sale and leaseback of its passive infrastructures completed in FY22.

Source: Phillip Capital Research - 29 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024