Silverlake Axis Ltd – Higher OPEX Hurt Earnings

traderhub8

Publish date: Thu, 18 May 2023, 09:55 AM

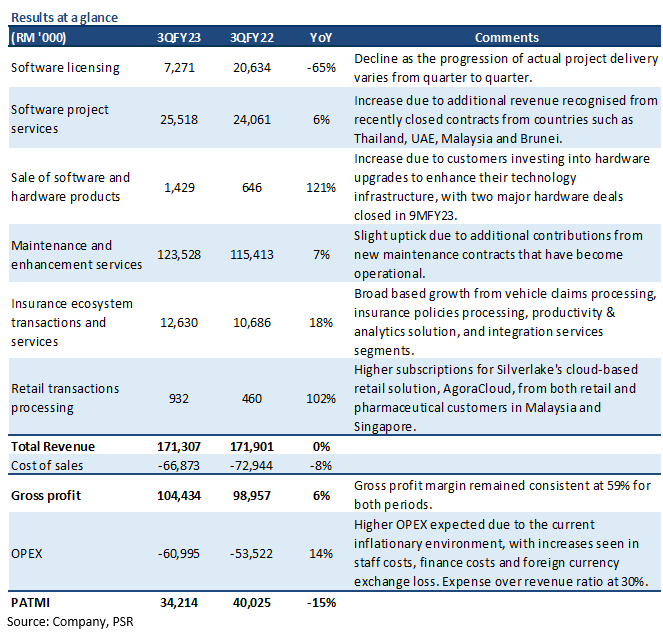

- 3QFY23 earnings of RM34.2mn were below our estimates. 9MFY23 earnings were at 64% of our FY23e. The 15% YoY dip in earnings came from higher-than-expected OPEX due to the current inflationary environment and a need to increase staff costs.

- Project-related revenue comprising software licensing and software project services fell 27% YoY. Silverlake recently signed their first multi-million 10-year core and channels digital banking MOBIUS deal with a client in Malaysia, total size of more than RM100mn of which RM30-40mn will be booked in the first year.

- We maintain BUY with an unchanged target price of S$0.49. We lower FY23e earnings by 7% as we increase operating expenses estimates for FY23e. Our target price is pegged to 21x P/E FY23e. We expect MOBIUS and the recovery in bank IT spending after two cautious pandemic years to be the key growth drivers for the company.

The Positives

+ Recurring revenue rose 8% YoY. Recurring revenue comprises maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue. Maintenance and enhancement services increased 7% YoY to RM124mn as the dip in enhancement services revenue was more than offset by the increase in maintenance revenue. The decline in enhancement services revenue was mainly due to the timing and progress of contracts fulfilment and delivery, and Silverlake anticipates this will be recognised and booked in the following quarter. Insurance ecosystem transactions and services revenue increased 18% YoY as there was broad-based growth

across all segments, from vehicle claims processing, insurance policies processing, productivity and analytics solutions, and integration services. Revenue from retail transactions processing surged 102% YoY mainly due to higher subscriptions for Silverlake’s cloud-based retail solution, AgoraCloud, from both retail and pharmaceutical customers in Malaysia and Singapore.

+ Order backlog healthy. Silverlake has a long track record and a proven client base in Southeast Asia. Three of the 5 largest Southeast Asia-based financial institutions use its core banking platform, and it has largely retained all its clients since bringing them on board its platform. Silverlake’s project pipeline is healthy, at RM1.8bn (2QFY23: RM1.8bn), with a record contract wins of RM259mn in 3QFY23 and an order backlog of RM261mn on the verge of closing in 4QFY23. Furthermore, Silverlake has recently secured their first multi-million 10-year core and channels digital banking MOBIUS deal with a client in Malaysia. Silverlake is beginning to close more deals and is witnessing an uptick in inquiries about its financial services market solutions and capabilities.

The Negatives

– OPEX rose 14% YoY. Operating expenses were 14% higher YoY mainly due to the current inflationary environment and a need to support long-term growth and sustainability. The increase was across all segments, with increases in staff costs due to additional headcount, increase in finance costs due to a revolving credit facility drawdown, increase in foreign currency exchange losses due to the fluctuation of foreign currencies, and higher costs for internal and external branding activities as markets opened up. Nonetheless, the expense over revenue ratio was kept at 30%.

– Project-related revenue fell 27% YoY. Software licensing revenue fell 65% YoY to RM7mn. This was mainly due to the progression of actual project delivery varying from quarter to quarter, resulting in a lag in revenue contribution. However, this was offset by software project services revenue increasing 6% YoY to RM26mn as there was additional revenue recognised from recently closed contracts from countries such as Thailand, UAE, and Malaysia. In addition, progressive project revenue recognised from on-going secured projects remained at a stable level.

Source: Phillip Capital Research - 18 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024