Thai Beverage PLC – No Fizz in the Beer

traderhub8

Publish date: Mon, 15 May 2023, 09:58 AM

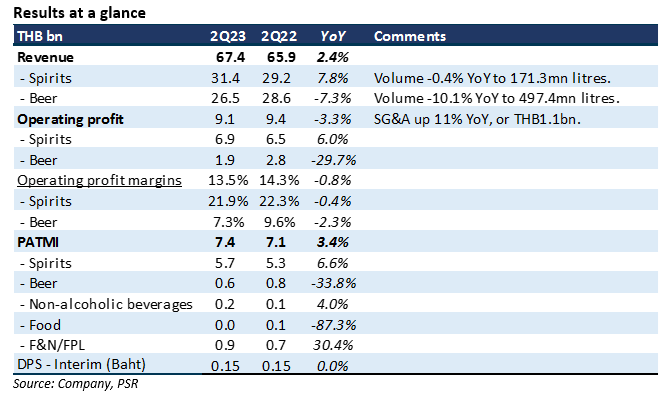

- Earnings were within expectations. 1H23 revenue and PATMI at 49%/52% of our FY23e forecasts. 2Q23 PATMI growth of 3.4% was driven by growth in spirits but dragged down by a major decline in beer earnings.

- 2Q23 beer volumes were down 10% YoY. Sabeco volume declined by double-digits due to distributors de-stocking and slowdown in economic growth. Consumer sentiment in Vietnam is weak, especially for the industrial sector.

- We maintain our FY23e forecast. We expect improvement in beer sales to gradually recover in Vietnam as tourist arrivals support consumption and economic activity. The activities around the general election in Thailand is another trigger for beer demand in the near-term. Our recommendation is upgraded from ACCUMULATE to BUY due to recent share price weakness. The target price of S$0.80 is unchanged. We peg 18x FY23e earnings for the core operations, its 5-year average. And listed associates are valued at market valuations.

The Positive

+ Better product mix and selling price for spirits. Spirits volume in 2Q23 rose 7.8% YoY to THB31.4bn (S$1.2bn). Revenue growth was from a larger mix of the higher priced brown compared to white spirits. The price increase also supported sales growth. The mix of brown and white spirits have not been disclosed except for double-digit revenue growth for brown and marginal decline in white spirits. There remain ample production capacity in spirits and capital expenditure is minimal. Raw material cost from molasses is expected to rise this year based on the recent Dec22-Apr23 annual harvest.

The Negative

– Beer volumes first decline in six quarters. Volume in 2Q23 declined 10.1% YoY, pulling down revenue by 7.3%. Operating margins fell as marketing expenses remain elevated. Gross margins were stable at 22.4%. Volumes decline was led by Sabeco, with revenues declining by 15% YoY in 1Q23. Vietnam, especially the industrial export sector, is suffering from weak economic conditions, job losses and poor consumer sentiment. Distributors are not willing to carry much inventory due to the weak demand and high interest rates. Thailand volumes were also impacted by higher prices but there has been market share gains.

Source: Phillip Capital Research - 15 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024