StarHub Limited – DARE+ Drag Delayed

traderhub8

Publish date: Mon, 15 May 2023, 09:57 AM

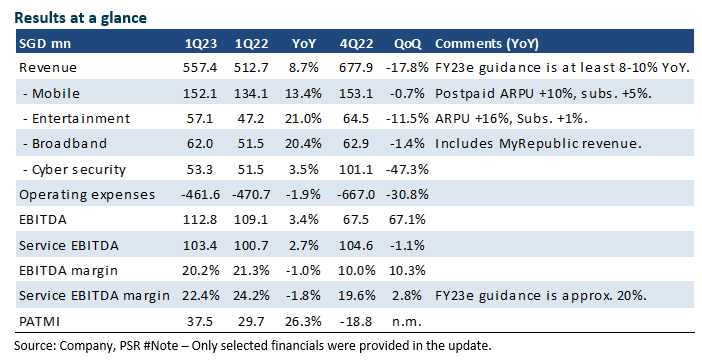

- Revenue and EBITDA were in line with expectations at 22%/25% of our FY22e estimates. 1Q23 revenue growth of almost 9% YoY was broad-based, especially mobile roaming revenue and higher ARPUs in entertainment.

- The extra investment into the DARE+ transformation was around S$25mn of the expected S$155mn to be spent this year. The bulk of this spend will be in opex. We estimate S$90mn.

- FY23e will be a transition year as StarHub undergoes huge expenditure namely in IT. In general, these investments will lower operating cost as networks and infrastructure are replaced and move to the cloud. Revenue opportunities are expected to come from the launch of a All-in-One app platform, more self-serve consumer features, faster speed and agility to launch products and providing Greentech and hybrid multi cloud capabilities to the enterprise segment. We maintain our FY23e forecast and NEUTRAL recommendation. The target price of S$1.08 is unchanged, pegged at 6.5x FY22e EV/EBITDA, in line with other mobile peers.

The Positive

+ Roaming revenue lifted mobile. Mobile revenue rose 13.4% YoY to S$152mn, supported by both ARPU and subscriber growth. Roaming is the largest driver of ARPU recovery despite ongoing migration to SIM only. Prepaid remains challenged with sluggish net adds and lower prices.

The Negative

– Weakness in broadband. Excluding the MyRepublic acquisition, broadband revenue declined an estimated 5% YoY to S$49mn. Broadband is facing higher price contribution. ARPU and subscribers were basically flat QoQ. The acquisition of MyRepublic has only lifted StarHub broadband ARPU by S$1 to S$34. The launch of SIMBA (formerly TPG) broadband plans will further pressure prices.

Source: Phillip Capital Research - 15 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024