Prime US REIT – Leasing Is the Top Priority

traderhub8

Publish date: Mon, 15 May 2023, 09:57 AM

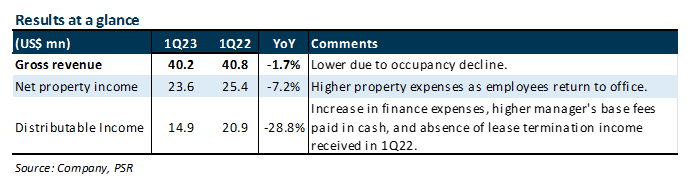

- 1Q23 distributable income was below expectations and 21% of FY23e forecast. The decline of 28.8% to US$14.9mn was due to Prime increasing management fees paid in cash from 20% to 100%, higher interest expense, absence of lease termination income, and higher operating expenses. Excluding the higher proportion of management fees in cash, distributable income is still down 22.5%.

- Portfolio occupancy dipped slightly to 88.6% from 89.1% in 4Q22, with overall rental reversions of -2.6%.

- Maintain BUY, DDM-TP lowered from US$0.70 to US$0.46 as we lower our FY23e DPU forecast by 18% due to management fees paid all in cash, lower occupancy, and higher costs. We also cut FY24e and FY25e DPU by 18% and 15% respectively. Catalysts include improved leasing and a greater return to the office. Prime is currently trading at 0.3x P/NAV and below pandemic lows, and we believe that most of the negatives are already priced in. The current share price implies FY23e/FY24e DPU yield of 23/25%.

The Positive

+ Extension of debt maturities. Prime is in the process of extending its 4-year term loan and RCF under its main credit facility (c.34% of total loans) by one year to July 2024 for an extension fee of 10bps. Expected completion is June 2023. This gives Prime some respite amid the credit crunch situation in the US.

The Negatives

– Portfolio occupancy dipped to 88.6% from 89.1% in 4Q22. The biggest contributors to the decline were Tower 1 at Emeryville (-7ppts QoQ to 69.1%) and Sorento Towers (-2.8ppts QoQ to 94.4%).

– Slowdown in leasing volumes. Prime signed 64.4k sq ft of leases in 1Q23 (-62% YoY and -55% QoQ). However, leasing activity picked up in April 23 with c.38k sq ft of leases executed. Portfolio rental reversions for the quarter were -2.6%, impacted by two renewals with minimal upfront tenant improvements Capex, but with high positive net effective rent reversions. Excluding the two abovementioned renewals, 1Q23 rental reversions would have been +3.2%.

– Gearing increased 1.6ppts QoQ to 43.7%, due to the increase in borrowings to fund 2H22 distribution at the end of March 2023. 79% of debt is either on a fixed rate or hedged (82% in 4Q22), with 62% of debt hedged or fixed through to 2026 or beyond. After the extension of debt, Prime has no refinancing obligations till July 2024. Prime’s effective interest cost for the quarter increased 30bps QoQ to 3.7%, and its interest coverage ratio is at 3.8x.

Source: Phillip Capital Research - 15 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024