CapitaLand Investment Limited – Lodging Business to Drive Growth

traderhub8

Publish date: Mon, 15 May 2023, 09:57 AM

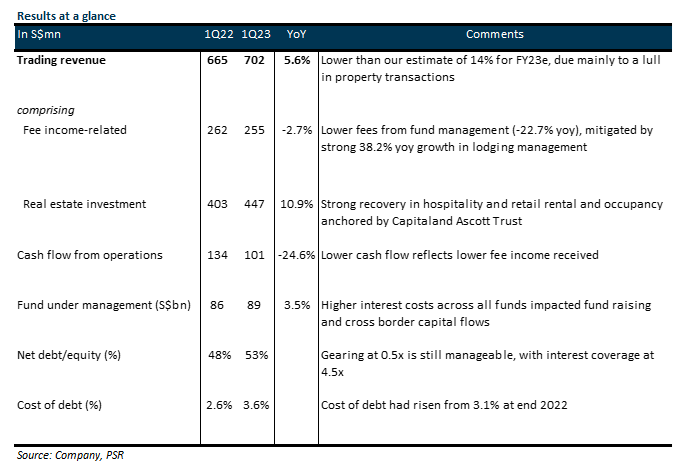

- 1Q23 revenue of S$702mn (+5.6% YoY) was slightly below our estimates, forming 21% of our FY23e forecast. This was due to lower event-driven fees from fund management (-S$33m or -68.8% YoY) with the lull in property transaction activities. Recurring fee income from fund management grew 3.5% to S$87mn.

- Revenue from the real estate investment business, which rose by 10.9% YoY, benefitted from strong recovery in the hospitality and retail sectors. CapitaLand Ascott Trust and CLI’s lodging management fees gained from higher rental and occupancy rates. 1Q23 portfolio RevPAU grew 42% YoY to reach 103% of 1Q19 pre-COVID RevPAU at S$81.

- Maintain ACCUMULATE with an unchanged SOTP TP of S$4.12. No change in estimates. Our SOTP derived TP of S$4.12 represents an upside of 17.1% and a forward P/E of 17x. The pick-up in travel and China’s continued re-opening will be immediate catalysts for CLI.

The Positives

+ Strong recovery in the lodging segment. Lodging management fee-related income grew 38.2% to S$76mn due to higher room rates as well as improved occupancy across the portfolio. Portfolio RevPAU grew 42% YoY to S$81 and is 103% of 1Q19 pre-COVID levels. The real estate investment business also benefitted from the recovery in the lodging segment, with revenue growing 10.9% YoY to S$447mn. With the FY23 target of 160k lodging units in the portfolio hit in 1Q23 after signing >4k units in 1Q23, the new target is to double its fee revenue from lodging management to >S$500mn in 5 years.

The Negatives

– 1Q23 revenue growth of 5.6% was below our estimate of 14% for FY23e, due to lower event-driven fees from fund management (-S$33m or -68.8% YoY) with the lull in property transaction activities. However, recurring fees held stable for private funds at S$23mn, while fees from listed funds grew 4.9% to S$64mn. As a result, fee related earnings from fund management fell 22.7% to S$102mn.

– Cash flow from operations fell 24.6% to S$101m, or FFO/share of 2cts. As a result, net debt/equity has risen to 0.53x, and interest coverage is lower at 4.5x. The cost of debt saw an increase of 50bp to 3.6% from end 2022, as only 62% of its debt is on fixed rate.

Source: Phillip Capital Research - 15 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024