Lendlease Global Commercial REIT – Resilient Performance

traderhub8

Publish date: Thu, 11 May 2023, 09:59 AM

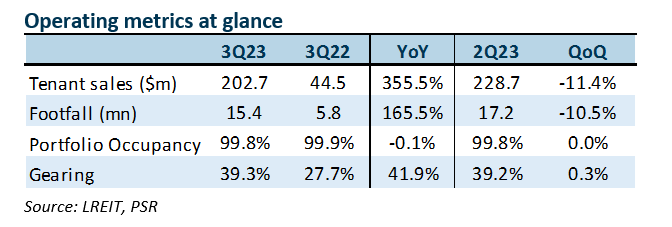

- No financials provided in this operational update. Portfolio occupancy remained stable at 99.8% QoQ but experienced a slight drop of 0.1% YoY. With higher rental reversion in retail, 3QFY23 reversions of c.3.3% improved from 1HFY23’s c.2%.

- Tenant sales at 313@Somerset and JEM are still trending above pre-Covid levels, c.15% and c.20% higher respectively. Cost of debt currently at 2.51% (+0.16% QoQ and +1.53% YoY).

- Maintain Buy with unchanged target price of S$0.91. We expect the organic growth from the additional GFA, higher positive rental reversion from the retail and onboarding of Live Nation to potentially offset the headwinds in borrowing cost. There is also an estimated S$5bn of assets in the pipeline from the sponsor.

The Positive

+ Retail recovery on track. Tenant sales have increased by 355.5% YoY at the portfolio level due to acquisition of Jem. Despite the slow return of Chinese tourists, tenant sales were still at c.120% of the pre-pandemic level since 80-90% of the sales are contributed by local demands. Portfolio occupancy remained strong at 99.8% (-0.1% YoY). As only 1.4% of leases expire in FY23, we expect the occupancy rate to remain stable. The retail side generated a positive rental reversion of 3.3% (+1.3% QoQ) while office rental escalation remained unchanged at 4%. With higher sales driving occupancy cost below average by c.3-5% at the portfolio level, there is still upside for the rental reversion.

The Negative

– The cost of debt has increased to 2.51% (+0.16% QoQ, +1.53% YoY). After the refinancing of the €285m loan in FY24, we expect the overall cost of debt to increase to c.3% and further deteriorate the adjusted interest coverage ratio (ICR) to c.2.1x. The gearing ratio is 39.3% (+0.1% QoQ, +11.6% YoY). As 61% of the borrowing is hedged for the next 18 months and there will be no refinancing risks till FY25, we expect the gearing to remain at its current level.

Outlook

In order to maintain gearing, we believe inorganic growth is unlikely unless LREIT is willing to take equity fundraising. However, there are still catalysts generated by organic growth, such as the additional 10,200 GFA at 313@Somerset. Upon full deployment, this could lift the NPI by 2-3%. We also expect rental reversion from the retail side to remain positive.

Source: Phillip Capital Research - 11 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024