Venture Corporation Limited – Weakness to Persist

traderhub8

Publish date: Mon, 08 May 2023, 09:59 AM

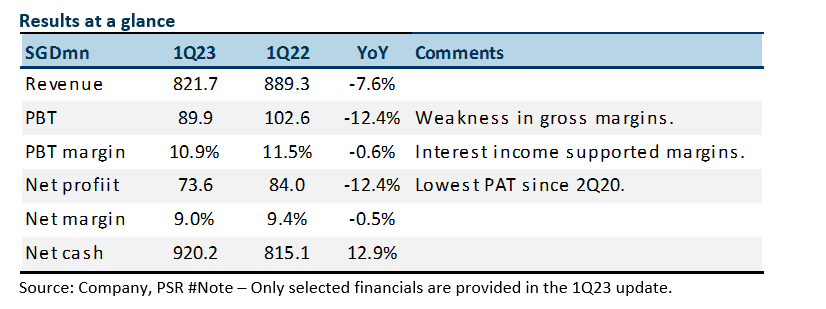

- 1Q23 results were below expectations. Revenue and PAT were 20%/20% of our FY23e forecast. PAT was the lowest in almost three years.

- Guidance by the company is that demand weakness is expected in the near term. Customers have turned more cautious in their orders.

- We cut our FY23e PATMI by 13% to S$311mn as we lowered revenue by 12%. Our recommendation is downgraded from ACCUMULATE to NEUTRAL. Our target price is lowered to S$17.10 (prev. S$19.70), 16x PE FY23e. There remains little visibility of a recovery. Demand continues to be weak. New product introduction that is expected to ramp up in coming quarters and migration of products away from supply chains in China will stem some of the weakness in demand.

The Positive

+ Improvement in net cash position. Net cash has improved by S$105mn YoY in 1Q23 to S$920mn. The high-interest rate environment with fixed deposit rates at 4% to 5% will be supportive of earnings this year.

The Negatives

– Inventory elevated ahead of slowdown. Venture exited 1Q23 with an inventory of S$1.017bn (1Q22: S$1.152bn). Annualised inventory days are around 138 days vs pre-pandemic average of 100 days. We believe there is excess inventory ahead of the coming slowdown in revenue.

– Revenue shrinking again. After enjoying revenue growth for the past five consecutive quarters, 1Q23 fell by 7.6% YoY. Our initial expectation was a modest 5% improvement in revenue for FY23e. However, the slowdown in the macro environment is causing revenue to fall sharper than expected. Venture is still finding difficulty crossing the record revenue of S$4bn achieved in FY17.

Outlook

Weakness in demand is across most sectors. Venture has performed better in instrumentation, life science and consumer luxury. Areas of future growth include electric vehicles and life sciences. To grow market share, Venture can migrate certain products out of China to SE Asia or help in the redesign of products. Demand is expected to remain weak in the near term as customers are cautious about their orders.

Source: Phillip Capital Research - 8 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024