Frasers Centrepoint Trust – Nearly-full Portfolio Occupancy

traderhub8

Publish date: Fri, 28 Apr 2023, 06:04 PM

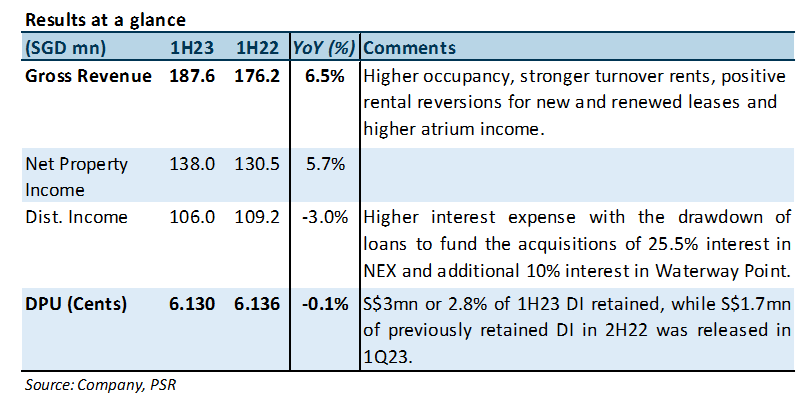

- 1H23 DPU of 6.130 Singapore cents (-0.1% YoY) was in line and formed 51% of our FY23e forecast.

- All portfolio properties achieved higher revenue and NPI YoY, supported by higher atrium income and rent growth. Retail occupancy reached a high of 99.2%; tenant sales and shopper traffic improved 9.2% and 35.3% YoY respectively.

- Maintain ACCUMULATE, DDM TP increased from S$2.31 to S$2.35 as we raise our FY23e-FY25e DPU estimates by 1-2% on the back of higher portfolio occupancy. Current share price implies a FY23e DPU yield of 5.5%.

The Positives

+ Retail portfolio occupancy improved 0.8%-point QoQ to 99.2%, mainly due to the backfilling of the anchor cinema space at Century Square, taking its occupancy from 88.7% to 96.8%. Occupancy at all nine malls came in at above 96.8%, with five malls having an occupancy of 99% or higher. 1H23 rental reversions for the retail portfolio were +1.9%, up from +1.5% in FY22. After starting FY23 with 27.6% of leases (by GRI) expiring in the year, 11.4% remain for the rest of this financial year. As a reflection of the strong underlying demand, about 16.2% of leases (by GRI) have been renewed in 1HFY23, with 11.4% yet to be renewed by this FY.

+ Tenant sales and shopper traffic grew 9.2% and 35.3% YoY, indicating resilient retail sales. However, we expect tenant sales growth to moderate going forward due to the increase in Goods and Services Tax rate and a slowdown in consumer spending.

The Negative

– Gearing increased from 33.9% to 39.6%, due to the increase in bank borrowings to finance the acquisitions of the effective 25.5% stake in NEX and the additional 10% stake in Waterway Point which were completed in February 2023. However, the proportion of fixed interest rate borrowings increased from 73.2% as at 1Q23 to 76.4%, and the all-in cost of debt increased only 10bps QoQ to 3.6%. FCT indicated that it has secured financing to refinance all borrowings due in FY23 (17.7% of total), which we think is likely at above 4%.

Source: Phillip Capital Research - 28 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024