Lendlease Global Commercial REIT – Organic and Inorganic Growth Opportunities

traderhub8

Publish date: Mon, 24 Apr 2023, 06:05 PM

- Organic growth of an additional 10,200 sft NLA, retail footfall to benefit from upcoming tenant Live Nation, c.3% annual rental escalation from 313@somerset and c.5.7% rental escalation tied to CPI growth from Milan commercial property.

- Inorganic growth opportunities from the sponsor’s stabilised asset pipeline, of up to c.$5bn.

- Resume coverage with a BUY recommendation and DDM TP (cost of equity 7.6%) of S$0.91. Valuations are attractive at FY23e yields of 6.6%.

Key Investment Merits

Organic growth to support valuation and DPU:

- Lendlease Global Commercial REIT (LREIT) is expecting its new tenant Live Nation to be fully renovated at the end of 2024. With a capacity of more than 2,000 concertgoers per event, four events per day translate to generate additional footfall of 1mn per year which is 2.5% of the total 313@somerset footfall. We expect more than 90% of the tenants (except money changers, gadget stores, etc) to benefit from the concerts.

- LREIT is also gradually deploying its additional plot ratio of 10,200 sft, 3.4% of the total NLA of 313@somerset. If LREIT is to deploy the entire 10,200 sft, we believe the plan is to convert Level 7/ Level 6 (currently a car park) into retail and expand higher-yielding floors such as Level 1. With the additional plot ratio and the presence of Live Nation, we expect the NPI of 313@somerset to increase by 2%.

- We expect an annual rental escalation in Sky Complex Milan of 5.7% based on 75% of March 2023 CPI growth.

Potential Inorganic growth opportunities: After capping gearing at 45%, LREIT is estimated to have a debt headroom of c.$207m which allows for piecemeal acquisitions of a small stake in PLQ Mall or Parkway Parade (PP) as Singapore remains its focus. We believe LREIT can acquire c.6.2% of PLQ Mall or c.14.7% of PP, assuming the cap rate for PLQ Mall and PP is c.4.5%.

Attractive Valuation: Based on the 2% terminal growth rate, we reinitiate with a BUY recommendation, and the DDM-backed target price is $0.91. We increased the COE to 7.6% to reflect the higher interest rates. We expect FY23-24e DPUs of $4.63 – 4.78 cents.

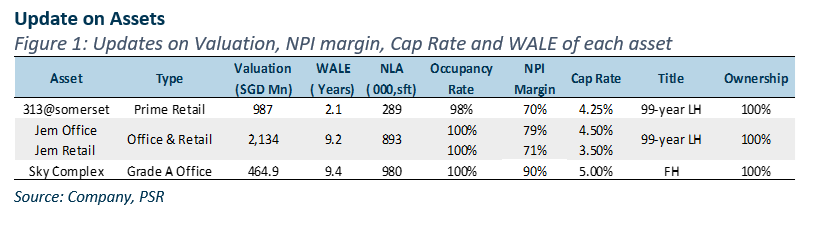

313@somerset

- 313@somerset has now positioned itself to be the incubator of new brands and businesses, a platform for business diversification from onshore to offshore. Famous brands such as TanYu and Chicha San Chen have chosen 313@somerset to initiate their pilot

- We expect a 30% decrease in CAPEX due to Live Nation taking most of the space on Grange LREIT is also actively managing its operating expenses by switching the utility contract to a lower-cost government contract.

Jem

- Office occupancy stays at 100% and it is fully leased to the Ministry of National Development.

- Tenant sales in Jem were up for c.20% YoY due to the resiliency from necessity spending and an increased footfall. We expect higher rental reversion due to the current low occupancy cost (rental charge/ tenant sales).

Sky Complex Milan

- Master tenant, Sky Italia’s lease ends in May 2032 with a physical occupancy rate at c.70% currently. The current market rental rate is c.€300-320/sqm per month, however, Sky Italia is renting at €188 / sqm. As such, we believe there is an upside in rental reversion upon lease expir

Source: Phillip Capital Research - 24 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024