Q & M Dental Group Ltd – Pursuing Operating Leverage Post-record Expansion

traderhub8

Publish date: Fri, 10 Mar 2023, 06:13 PM

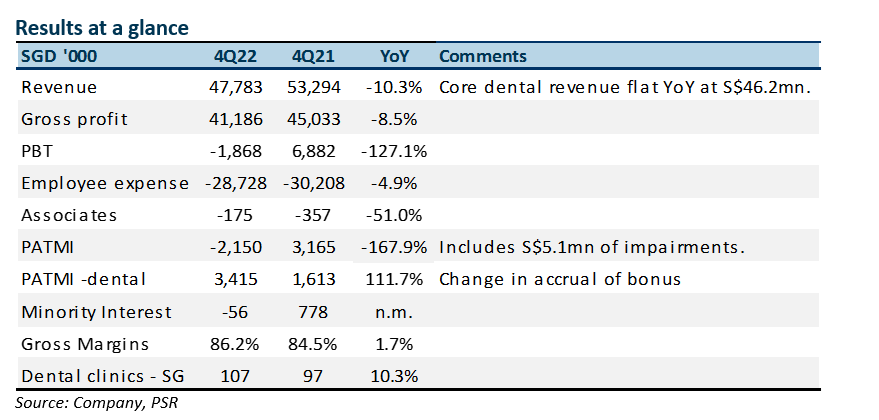

- Revenue met expectations but earnings were below. FY22 revenue and adjusted PATMI were 99%/90% of our forecast. The significant drop in COVID-19 related earnings and higher expenses in the development of AI-guided clinical support systems were the drag.

- Our adjusted PATMI excludes S$5.1mn of impairment of inventories (S$4.9mn) and plant and equipment (S$0.2mn) incurred in 4Q22.

- We are lowering our FY23e PATMI by 17% to S$17.9mn. After increasing the number of clinics by a record 34 (or 30%) over the past two years, the focus is to raise utilisation. Q&M continues to recruit dentists to fill its existing chain of clinics and upgrade the skills of dentists. Our BUY recommendation is maintained but target price lowered to S$0.47 (prev. S$0.52). We value the company at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.115, Not Rated), is valued at market price with a 20% discount.

The Positive

+ Number of clinics expanded. In FY22, Q&M expanded the number of clinics by 16 (or 12%). Most of the new clinics were in Singapore, with 10 new clinics. Profitability from core dental operations tripled to S$3.4mn. This was due to a change in the accrual of staff bonuses from a lumpy 4Q to proportionate provisioning per quarter.

The Negative

– Revenue per clinic declined. 4Q22 revenue per clinic declined by 12% YoY to S$382k. New clinics have not reached maturity, as nurse shortages and the re-opening of borders have dampened visits. Nevertheless, total revenue from core dental was flat YoY at S$46.2mn.

Outlook

The priority in FY23 is to raise the utilisation of the existing clinics. After the aggressive expansion over the past two years (34 clinics), the company will look to raise visits and revenue intensity per patient. Recruitment into the existing network of clinics will boost the availability of dentists. Improving the skill sets of the current dentists is another initiative to increase revenue intensity. Q & M is also pursuing an AI-guided dental software that creates an ethical standard cum procedures that supports dentists.

Source: Phillip Capital Research - 10 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024