PropNex Ltd – Nice Set-up for 2023

traderhub8

Publish date: Mon, 06 Mar 2023, 06:16 PM

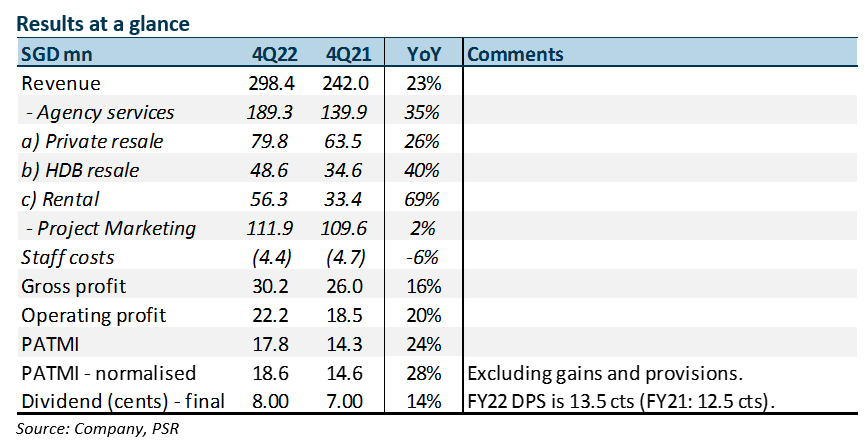

- 4Q22 earnings growth of 24% YoY to S$17.8mn exceeded our expectations. FY22 revenue and PATMI were 107%/107% of our FY22e forecast. Despite lower new launches, PropNex successfully pivoted towards the resale and rental market. The higher GST may have also pulled in earlier recognition of some transactions this quarter.

- Rental was the highlight with revenue growth of 69% YoY to S$56mn. Other areas of strength were private and HDB resale. Final dividend was raised by 14% 8 cents and a 1 for 1 bonus issue was announced.

- We believe the set-up for FY23e is positive. Property prices are expected to be stable but volumes are expected to rebound strongly. New launches are expected to be almost triple last year’s 4032 units. The rental market is expected to be supported by around 17,000 private home completions, and resale could be buoyed by 4,000 EC and 16,000 HDBs (plus higher grants) reaching their minimum occupancy period. Another driver to earnings is the 8% jump in salespersons to 11,667. We raised our FY23e earnings by 8% to S$68.3mn and the target price is raised to S$2.40 (prev. S$2.00). Our BUY recommendation is maintained.

The Positives

+ Strong market share gains. FY22 was a banner year for PropNex. Despite the drop in primary and secondary transaction volumes by 23% and residential leasing being down by 8% in 2022, revenue grew 8% to a record S$1bn. We believe there were market share gains, especially against the smaller agencies. A key differentiator has been their sales process and continuous efforts in engaging consumers that pivoted to the other segments, as primary sales were sluggish due to the collapse in new launches.

+ As expected, ample cash flow. FCF generated in FY22 was S$48.7mn (FY21: S$80mn). There was higher working capital of S$23mn tied up with receivables than a year ago. PropNex ended FY22 with net cash of S$138mn (FY21: S$145mn). The current dividend is around S$50mn p.a., well supported by annual operating cash flow and net cash.

The Negative

– Timing in recognition of commission. In 4Q22, PropNex made an impairment loss of S$5.5mn on receivables. The net impact on the income statement is offset by S$4.1mn derecognition of trade payable to agents. PropNex makes an impairment of its trade debtors for commissions not paid within 365 days. Two developers hit their 5% marketing fees limit. Both developer projects have been fully sold and the commission will be repaid when the projects reach their temporary occupation permit or completion.

Source: Phillip Capital Research - 6 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024