Venture Corporation Limited – Outlook Starting to Dim

traderhub8

Publish date: Mon, 27 Feb 2023, 06:18 PM

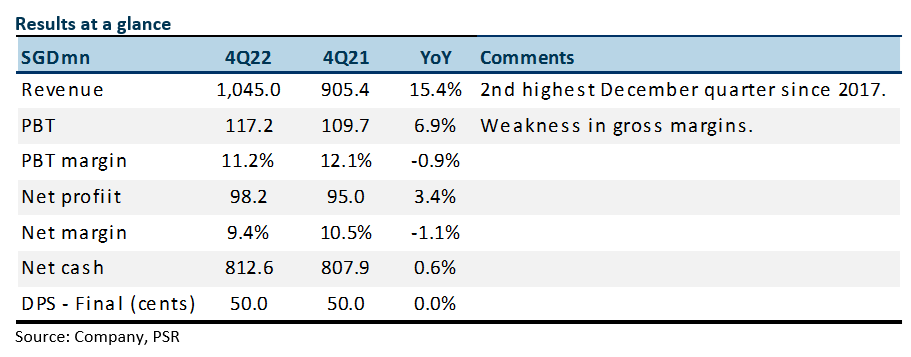

- FY22 results were within expectations. Revenue and PATMI were 102%/97% of our FY22e forecast. 4Q22 PAT rose 3.4% YoY. Gross margin was the weakest in seven years.

- There was caution in the company’s outlook. The environment in the short term is uncertain. Healthcare, life science and semiconductor sectors are the medium-term opportunities with their long product cycles.

- We lower our FY23e PATMI by 9% to S$359mn and downgrade our recommendation from BUY to ACCUMULATE. Our target price is lowered to S$19.70 (prev. S$20.80), 16x PE FY23e. The macro backdrop for electronic exports has declined significantly and the global economy slowing.

The Positive

+ Healthy growth in revenue. 4Q22 revenue grew 15% YoY to S$1.04bn, the 2nd highest December quarter since 2017. Growth was from the life science, medical device and healthcare domain. Pre-pandemic, revenue growth was a negative 4% from FY17 to FY19. We also expect revenue growth to slow in 2023 with the absence of the Malaysia re-opening lift experienced in 2022.

The Negative

– Major decline in margins. 2H22 gross margins declined 2.1% points to 23.7%, the lowest levels since 2015. We believe Venture had to absorb the higher-priced raw materials which were bulked up over the past few quarters. Venture still maintains a high S$1bn of inventories. There was operating leverage at the operating cost level due to the appreciating US dollar.

Source: Phillip Capital Research - 27 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024