Oversea-Chinese Banking Corp Ltd – Lower Fee and Insurance Income Offset NII Growth

traderhub8

Publish date: Mon, 27 Feb 2023, 06:18 PM

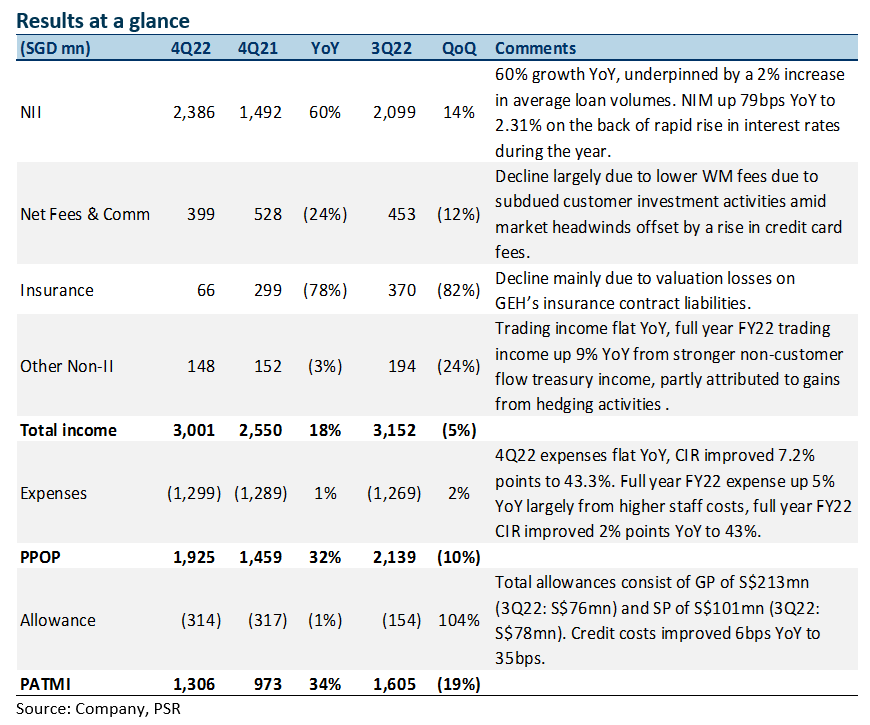

- 4Q22 earnings of S$1.31bn were below our estimates. It came from lower fee and insurance income offset by higher net interest income. FY22 PATMI was 89% of our FY22e forecast. 4Q22 DPS was up 43% YoY to 40 cents; full-year FY22 dividend rose 28% YoY to 68 cents.

- NII grew 60% YoY underpinned by loan growth of 2% YoY and NIM surging 79bps YoY to 2.31%. Total non-interest income dipped 42% YoY due to lower fee and insurance income. Allowances stable YoY at S$314mn.

- Maintain BUY with a higher target price of S$14.96 (prev. S$14.22). We lower FY23e earnings by 8% as we lower NII but increase fee income estimates for FY23e. We assume 1.29x FY22e P/BV and ROE estimate of 10.8% in our GGM valuation. Catalysts include continued interest income growth and fee income recovery as economic conditions improve. OCBC is our preferred pick among the three banks due to attractive valuations and yield of 5.4%, huge dividend buffer from the 15.2% CET 1, and fee income recovery from China’s reopening.

The Positives

+ Net interest income surged 60% YoY. NII grew 60% YoY led by loan growth of 2% YoY and NIM improvement of 79bps YoY to 2.31%. Loan growth was largely driven by lending in Singapore, Australia, the United States and United Kingdom. NIM expansion was mainly due to loan yields rising faster than the increase in funding costs on the back of the rapid rise in interest rates during the year. OCBC has guided for a NIM in the region of 2.10% for FY23e.

+ Credit cost improved by 6bps YoY. Total allowances fell 1% YoY but were up 105% QoQ to S$314mn. GPs of S$213mn (3Q22: S$76mn) and SPs of S$101mn (3Q22: S$78mn) were

made during the quarter. Total NPAs were down 5% QoQ and 20% YoY to S$3.49bn, and the NPL ratio improved by 30bps YoY to 1.2%. Notably, there was an increase in Greater China NPLs by 21% QoQ mainly due to the downgrade of a corporate relationship in Hong Kong. Nonetheless, OCBC said that it is a fully secured customer with LTV of >60% and the risk is non-systemic and is not related to mainland China real estate. Credit costs improved by 6bps YoY to 35bps due to the better credit environment.

The Negatives

– Fee income fell 25% YoY. Fee income declined 25% YoY to S$399mn mainly due to a drop in wealth management fees as customer activities were subdued amid risk-off investment sentiments globally. Nonetheless, OCBC’s wealth management AUM was higher at S$258bn (4Q21: S$257bn) mainly driven by continued growth in net new money inflows which offset negative market valuation.

– Insurance and trading income fall. Life insurance profit from Great Eastern Holdings fell 78% YoY from lower net valuation gains in its insurance funds experiencing unrealised mark-to-market loss on its insurance contract liabilities. Trading income also fell 2% YoY and largely customer flow treasury income.

– CASA ratio dipped YoY. Current Account Savings Accounts (CASA) ratio fell 11.5% YoY to 51.8% due to the high interest rate environment and a move towards fixed deposits (FD). Nonetheless, total customer deposits increased 2% YoY to S$350bn mainly due to the growth in FDs. The Group’s funding composition remained stable with customer deposits comprising ~83% of total funding.

Source: Phillip Capital Research - 27 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024