SATS LTD – Launched $800mn Rights Issue

traderhub8

Publish date: Fri, 24 Feb 2023, 06:18 PM

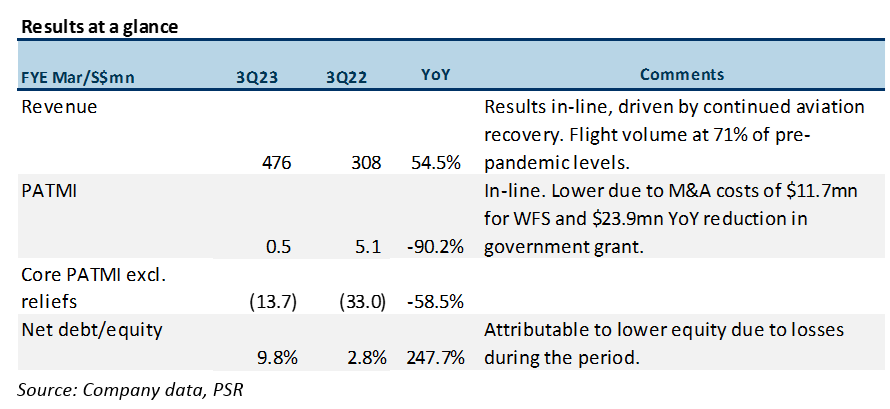

- 9M23 revenue in line, at 80.7% of FY23e. Its profitability continued to recover with core PATMI excl. reliefs at -$13.7mn vs. -$33mn in the same period last year.

- SATS shareholders will be allotted rights to subscribe for 323 rights shares for every 1,000 existing shares held at the price of $2.20 per rights share, representing a 16% discount to TERP.

- Funding clarity and all necessary approvals from all jurisdictions received should lead to a re-rating of the Company post rights-issuance.

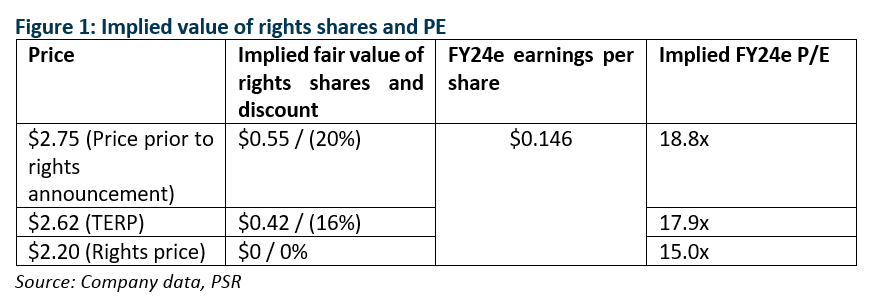

- Maintain NEUTRAL with lower target price of $2.92 (prev. $3.08). We trim FY24e earnings by 3% as we account for higher share base from a lower-than-expected rights price. Our valuation is pegged to 20x FY24e. Risks to our view include 1) Integration challenges for WFS; and 2) revenue growth continuing to lag behind expenses growth.

The news

SATS announced that it will undertake a renounceable, underwritten rights issue to raise gross proceeds of approximately $798.8mn to partially fund its acquisition of WFS. Entitled shareholders will be allotted rights to subscribe for 323 rights shares for every 1,000 existing shares held at the price of $2.20 per rights share, representing a discount of 16% to TERP.

The Positives

+ 9M23 revenue in-line, at 80.7% of FY23e. Seasonally strong 3Q23 revenue grew 54.5% driven by aviation recovery and Asia Airfreight Terminal (AAT) consolidation. Flight volume and air travel continue to recover as travel restrictions around the world eased. Its profitability continued to recover with core PATMI excl. reliefs at -$13.7mn vs. -$33mn in the same period last year driven by improved passenger-related operating statistics. We use core PATMI excl. reliefs as a measure of the Group’s profitability as this excludes one-off acquisition expenses and temporary government relief.

+ All necessary approvals from all jurisdictions received. With all the regulatory conditions for the transaction having been satisfied, SATS’ proposed acquisition of WFS is expected to close on 3 April 2023. The acquisition will strengthen SATS leading positions in strategic hubs connecting key trade lanes across North America and Europe, complementing its operations in Asia Pacific.

+ Funding clarity remove overhang. With the launch of the $800mn equity fund raising, we believe the overhang on the Company will be removed. At $2.20/rights share, this translates to an implied 15x FY24e (Figure 1), -1sd below its historical average P/E, which is attractive in our view. The theoretical ex-rights price (TERP) post-issuance is $2.62. Our target price of SATS represents a 11% upside to TERP.

The Negatives

– Higher share base post-completion from a lower-than-expected rights price. We had previously assumed a rights issue price of $2.29 based on a 15% discount. The steeper discount however, meant a slightly bigger dilution (-2%) to our FY24e earnings.

Source: Phillip Capital Research - 24 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024