Singapore Telecommunications Ltd – Currency Headwinds Everywhere

traderhub8

Publish date: Mon, 20 Feb 2023, 06:19 PM

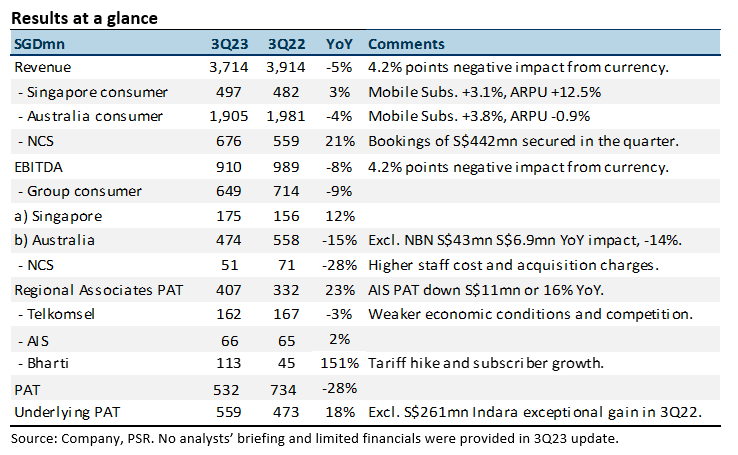

- 9M23 revenue met expectations at 73% of our FY23e estimates. EBITDA was below at 67%. There was an 8% point drag from the weaker Australian dollar. Underlying PAT rose 18% YoY to S$532mn, supported by a 23% rise in associate profit to S$407mn.

- Bharti net profit spiked 151% YoY to S$113mn, despite a 7% decline in the Indian Rupee. Optus operating metrics were stable post the cyber-attack in September.

- We lower our FY23e revenue/EBITDA by 5% and 7% respectively as we lower our Australian dollar assumptions by 10%. Our target price declined from S$3.05 to S$2.84 and we maintain our ACCUMULATE recommendation. Earnings growth continues to build up in India and Singapore. Weaker segments are sluggish earnings in Optus and NCS.

The Positive

+ Bharti is still the star performer. 3Q23 PAT for Bharti jumped 151% YoY to S$113mn despite the 7% currency headwind. Earnings growth was supported by mobile ARPU in India rising 18% YoY to Rs193 (S$3.10) and 4G subscriber growth of 11% to 216.7mn subscribers.

The Negative

– Optus sluggish profits. Mobile subscribers were flat QoQ at 10.3mn despite some initial churn post the cyber attack. Nevertheless, EBITDA contracted 14% YoY to S$474mn from increased staff and investments in new businesses.

Outlook

The two growth drivers for Singtel remain Bharti and Singapore mobile. Optus and NCS profitability is still sluggish. Optus requires significant realignment of cost to improve on its persistently paltry returns of 0.8% ROE (annualised). NCS is in an investment phase in building up its IT headcount, especially in more competitive geographies.

Source: Phillip Capital Research - 20 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024