NetLink NBN – Trust Yield Not Attractive Enough

traderhub8

Publish date: Wed, 15 Feb 2023, 06:21 PM

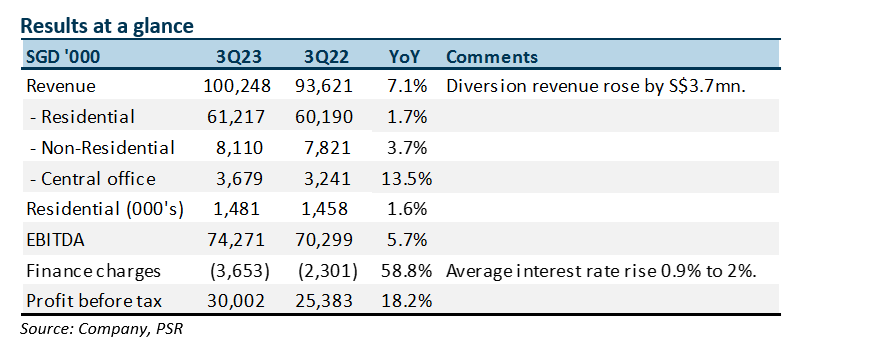

- 9M23 revenue was within expectations but EBITDA exceeded, at 76%/80% of our FY23e forecasts. 3Q23 revenue was up 7% driven by a spike in diversion revenue to S$5.6mn.

- Completion of the regulatory review of fibre prices is expected to be completed by the March quarter. Points of discussion include WACC, allocation of cost by segments and how much of the recent spike in interest rates and inflation should be considered.

- Our base case is that fibre rates will be nudged marginally lower. Any impact on dividends is muted due to the ability to raise borrowings. Our FY23e EBITDA is raised by 5%, from higher diversion revenue and more stable staff and other operating expenses. Our NEUTRAL recommendation and DCF target price of S$0.85 is maintained. We find the dividend yield of 6% less attractive, especially with limited growth in dividends and headwinds from rising interest expense.

The Positive

+ Pick up in diversion. Bulk of the growth came from the almost tripling of diversion revenue to S$5.6mn. The rise is due to heavy infrastructure projects – from MRT to highways – to which demand for diversion has jumped. Pre-pandemic, diversion revenue was trending at similar levels of S$5.4mn per quarter. Other segments that enjoyed revenue growth were NBAP (+38^ YoY) and central office (+13.5% YoY).

The Negative

– Interest rates start to bite. Net finance charge jumped almost 59% to S$3.6mn in 3Q23. Of the S$690mn of gross debt, 73.9% or S$510mn is fully hedged til 2026. The balance is an unhedged S$180mn floating rate loan at SORA plus a margin. Effective average interest rates have risen from 1.1% to 2.0%.

Outlook

The pressure points from higher interest rates remain. High-interest rates (and increased CAPEX for a new central office) will cap the growth in operating cash flows and the attractiveness of the current 6% dividend yield.

Source: Phillip Capital Research - 15 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024