Thai Beverage PLC – a Slow Start to FY23

traderhub8

Publish date: Mon, 13 Feb 2023, 06:22 PM

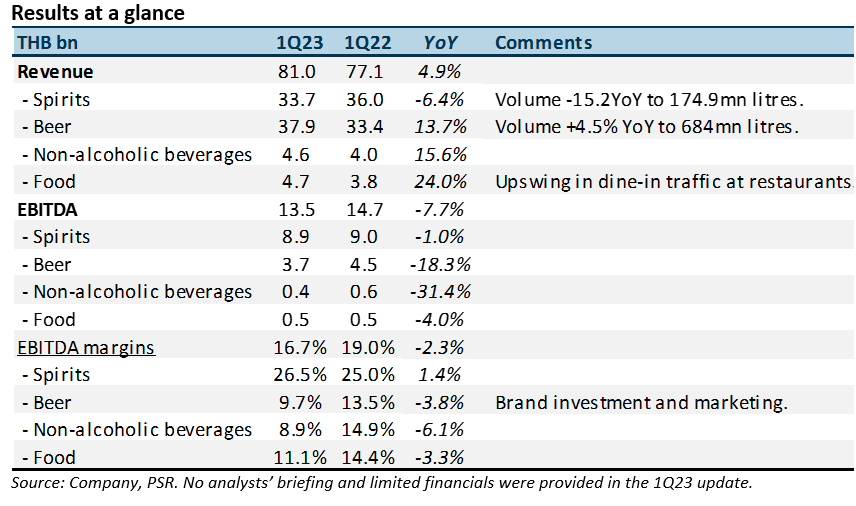

- 1Q23 revenue/EBITDA was below expectations at 27%/and 25% of our FY23e forecasts, respectively. 1Q is a seasonally stronger quarter.

- 1Q23 spirits volume contracted 15% YoY to 175mn litres after record volumes a year eariler, which enjoyed trade-inventory loading ahead of price increases.

- Our FY23e earnings are maintained. We expect earnings to recover with the re-opening of borders in Thailand, event-driven spending from the election and improvement in economic conditions. Our BUY recommendation is downgraded to ACCUMULATE following the recent share price performance. The target price of S$0.80 is unchanged at 18x FY23e core earnings, its 5-year average.

The Positive

+ Rebound in beer revenue. Beer continued to enjoy revenue growth of 13.7% YoY driven primarily by higher prices. The uptick in volumes was a more modest 4.5% YoY to 684mn litres. Sales growth in Vietnam is expected to weaken near-term due to the weakening economy, especially in manufacturing. Sabeco could pick up some volumes if consumers trade down from mass premium to mainstream brands.

The Negative

– Weak spirit volumes. Revenue declined 6.4% YoY, dragged down by a contraction of volumes by 15.4% YoY. Offsetting the weak volumes were higher prices and a better sales mix of brown spirits (vis-à-vis white spirits). A year ago volumes benefitted from front-loading of volumes ahead of price increases.

Outlook

1Q23 faced tough comparables due to the heavy front-loading of volumes a year ago. Even excluding the base effect, volumes declined 8% against 1Q21. We worry higher prices may have negatively impacted volumes. Margins are also weaker from higher marketing spend to boost brand-building after cut-backs during the pandemic.

Downgrade from BUY to ACCUMULATE with unchanged TP of S$0.80

Our target price stays at S$0.80, based on 18xFY23e earnings, its 5-year average, plus associate market cap.

Source: Phillip Capital Research - 13 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024