CapitaLand Ascott Trust – On the Right Track

traderhub8

Publish date: Thu, 09 Feb 2023, 06:23 PM

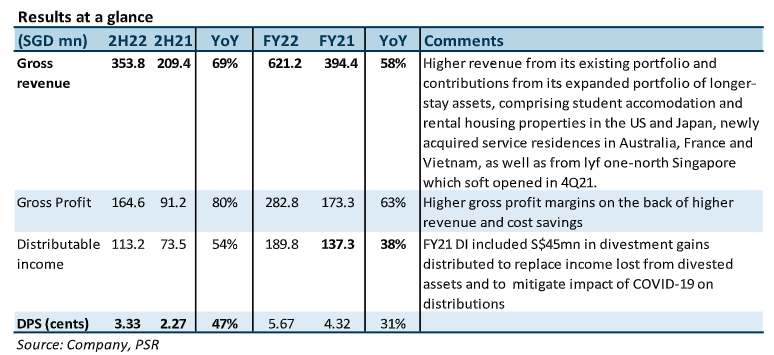

- FY22 DPU of 5.67 cents (+31%) was in line with our forecast, supported by new acquisitions and the recovery of travel.

- 4Q22 portfolio RevPAU rose 78% YoY to S$155, reaching pre-pandemic 4Q19 levels on continued improvement in portfolio occupancy (78% vs 60% in 4Q21) and average daily rates (ADR).

- Maintain BUY, DDM-TP raised from S$1.13 to S$1.26. FY23e-FY25e DPU is raised by 1-3% on the continued recovery for hospitality and the reopening of China. Our cost of equity decreased from 8.34% to 7.96% as we roll forward our forecasts. CLAS remains our top pick in the sector owing to its mix of stable and growth income and geographical diversification. The current share price implies a FY23e dividend yield of 5.9%.

The Positives

- 4Q22 RevPAU grew 78%/17% YoY/ QoQ to S$155, reaching pre-pandemic 4Q19 pro forma RevPAU. YoY improvement was driven by both higher average daily rates (ADRs), which is up c.37% YoY in 4Q22, and higher occupancy of 78% in 4Q22 (4Q21: 60%). All markets experienced strong RevPAU growth YoY (see Figure 1), with Singapore, Australia, US and UK RevPAU at or above pre-COVID-19 levels. Management guided that the growth drivers for RevPAU in 2023 were in China, Japan, and Vietnam which are currently at 80%, 73% and 78% of 4Q19 levels, respectively.

- Portfolio valuation remained stable. CLAS reported a gross fair value gain of c.S$200mn despite higher capitalisation and discount rates used across all markets (with the exception of Japan), due to the stronger operating performance and improving outlook of the portfolio. Across most markets, capitalisation rates increased by 25-50bps. Markets with valuation gains included those with RevPAU above normalised levels such as Singapore, Australia, USA and UK (3 – 7% YoY increase).

- Prudent capital management, with c.78% of debt on fixed rate, locked in for a weighted average of c.4 years. CLAS’ cost of borrowing remained low for the quarter at 1.8%, with an interest cover of 4.4x. Gearing of 38% means a debt headroom of c.S$1.8bn, leaving room for CLAS to reach its medium-term asset allocation of 25-30% for longer-stay accommodation (currently at 19%). Only 14% of total debt, or about S$400mn, is due for refinancing in 2023. CLAS expects average borrowing costs for the full year 2023 to be around 2.05%. A 50bps increase in benchmark rates will impact full-year DPU by 0.1 cents.

The Negative

- Foreign exchange headwinds continue to impact DPU. The impact of foreign exchange after hedges in place on gross profit was 2.8% for FY22. CLAS adopts a natural hedge wherever possible by borrowing in the currency of the underlying assets. A 5% depreciation in foreign currency implies a c.3% impact to DPU.

Outlook

Extended stay segment remains resilient, comprising c.15% of 4Q22 gross profit. Occupancy of the longer stay properties remained stable at >95%. Student accommodation continues to be resilient with 99% leased for the academic year 2022-2023 (vs 95% last academic year), with above market rent growth of c.6% YoY. Longer-stay accommodation offers income stability as the hospitality properties capture growth from recovering markets.

Forward bookings remain healthy, supported by the recovery of both short and long-stay corporate travel. Although there is not much increase in bookings from Chinese tourists, inquiries are strong. In 2019, Chinese travelers contributed about 9% of CLAS’ guests count (3% in 2022), and we expect this to pick up in 2H of 2023.

CLAS can raise room rates to abate rising utility and labor costs. Electricity cost increased but remain <10% of OPEX. Electricity charges are passed through to tenants in US student accommodation and Japan rental housing properties, while utility usage above a certain threshold will be passed through to guests in long-staying SRs.

Four properties will be undergoing enhancements in 2023. They include Riverside Hotel Robertson Quay, which will be rebranded as The Robertson House by The Crest Collection, Citadines Holborn-Covent Garden London, Citadines Les Halles Paris and Citadines Kurfürstendamm Berlin.

Maintain BUY, DDM-based TP raised from S$1.13 to S$1.26.

FY23e-FY25e DPU is raised by 1-3% on the continued recovery for hospitality and the reopening of China. Our cost of equity decreased from 8.34% to 7.96% as we roll forward our forecasts. CLAS remains our top pick in the sector with its geographically diversified portfolio, wide range of lodging asset classes, stable income base which has proven its resilience through COVID-19, and a strong sponsor. We also like that CLAS has a good mix of stable and growth income sources of 52% and 48% of 2H22 gross profit, respectively. The current share price implies a FY23e dividend yield of 5.9%.

Source: Phillip Capital Research - 9 Feb 2023

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024