Keppel Corporation – Urban Development Weighs on FY22 Earnings

traderhub8

Publish date: Tue, 07 Feb 2023, 06:24 PM

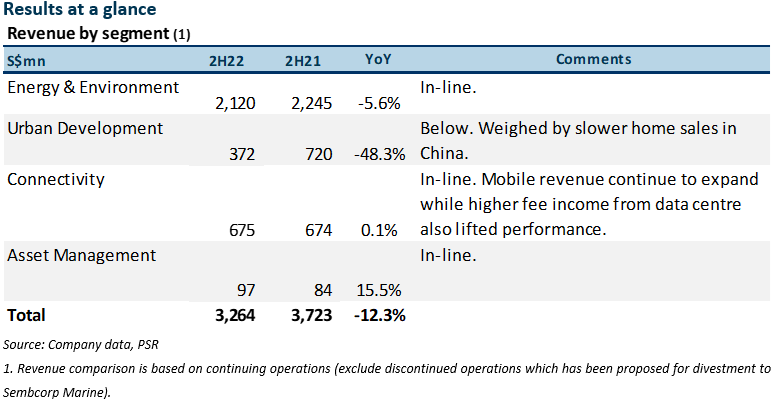

- FY22 net profit was below expectations, at 92% FY22e profit. Net profit of $927mn (-9% YoY) was under our expectations as Urban Development continued to underperform due to headwinds from China’s property market.

- $4.6bn in asset monetisation was announced, on track to exceed $5bn by this year. Another ~$10bn in assets to be monetised.

- Asset management target raised to $200bn from $100bn previously. This segment is the fastest-growing segment of the Group and the largest contributor to its earnings in FY22.

- Maintain BUY with higher SOTP TP of $9.54 (prev. $8.95). We adjusted our estimates for Keppel O&M and Asset Co higher, following the partial reversal of impairments made and the clearer path to divestment. Our TP translates to about 1.2x FY23e book value, a slight premium to its historical average as the Group’s transformation plans gain traction. Catalysts expected from approvals obtained for the transaction.

Positives

+ $4.6bn in asset monetisation, on track to exceed $5bn by this year. Another ~$10bn in assets to be monetised. Keppel has unlocked $4.6bn in capital from asset monetisation since announcing its target to monetise $3-5bn within three years. We believe the Group is set to exceed this target by this year. Moving ahead, we believe Keppel will move to monetise another ~$10bn of assets it previously identified for monetisation. It had previously listed $17.5bn of assets it is seeking to monetise as part of its strategy to transform its Group to be more asset-light.

+ Write-back of $293mn of impairments for certain legacy rig assets. With improving offshore and marine market conditions, including recovery of oil prices, higher rig utilisation and day rates contracted, the Group has partially written back $293mn of impairments which had been made in 2020 for certain legacy rig assets. This raised the Group’s total realisable value from its proposed O&M transactions to $9.6bn (or $5.52 per share) from ~$9.3bn (or $5.34 per share) previously.

+ Asset management target raised to $200bn from $100bn previously. Having achieved its AUM target of $50bn at the end of 2022, Keppel has raised its previous target of growing its AUM to $200bn over time from $100bn previously. This segment is the fastest-growing segment of the Group and was the largest contributor to the Group’s net profit in FY22.

Negatives

– FY22 net profit below expectations, at 82% of FY22e profit. Net profit of $927mn (-9% YoY) was under our expectations as Urban Development continued to underperform due to headwinds from China’s property market. Contribution from the Sino-Singapore Tianjin Eco-City were also lower YoY, as there were no land sales in 2022, compared to the sale of a commercial and residential land plot in 2021.

Source: Phillip Capital Research - 7 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024