Del Monte Pacific Limited – Record Margins From Price Increases

traderhub8

Publish date: Mon, 12 Dec 2022, 10:49 AM

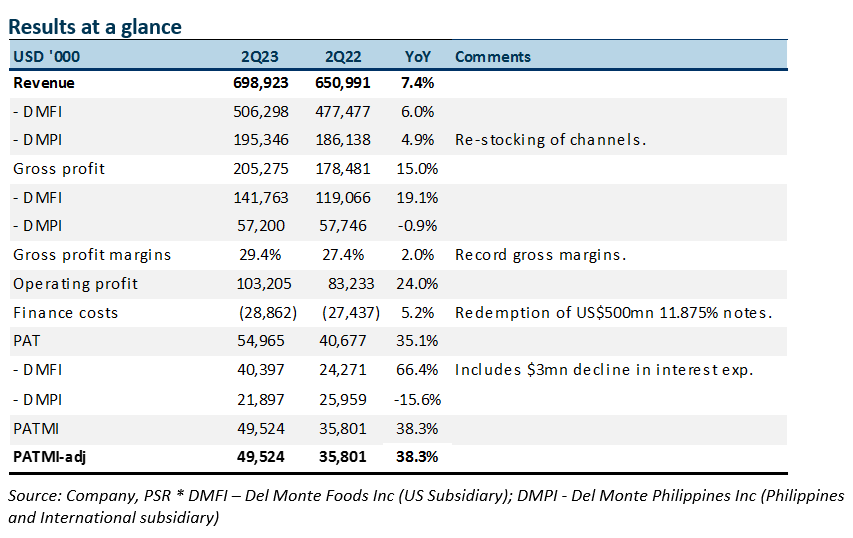

- The results were better than expected. 1H23 revenue and PATMI (excluding one-offs) were 49%/67% of our FY23e forecast. The continued push towards branded products drove gross margins to 29%, and is ahead of our modelled 26% from increases in selling price.

- 2Q23 earnings jumped 38% YoY to US$49.5mn supported by revenue growth (+7%) and expansion in both gross (+2% points).

- We raise our F23e earnings by 19% to adjusted US$123mn. We maintain our BUY recommendation and nudge our target price lower to S$0.67 (prev. S$0.69), pegged to 8x FY23e P/E, a huge 50% discount to the industry valuation due to its smaller market cap and higher gearing. Del Monte valuations are attractive at 4x PE FY23e and an 8% dividend yield. Multiple rounds of price increases and new products have supported gross margin expansion despite cost pressures. The drive towards more branded and new products in the US continues to bear fruit.

The Positives

+ Record gross margins. Gross margin climbed to record high 29.4%, a 2% point rise YoY. Margin gains were from US operations from multiple price increases over the past 18 months. These have supported margins despite raw material and logistics cost pressure. There was also operating leverage from a slower 6% rise in general and administration expenses.

+ Sharp rebound in Philippines. Sales in the Philippines and International (DMPI) recovered strongly in 2Q23, surging 22% YoY in peso terms to PHP11.3bn. However, revenue in USD terms only improved by 5% due to the weakness in the Philippine peso. Growth stemmed from the transition to new distributors in the last quarter and a rebound in food service (+21% YoY) and convenience stores (+48% YoY) as the lockdowns ease.

The Negative

– Rise in net debt by US$505mn to US$2bn. Net debt to EBITDA climbed from 4.3x to 5.6x over the past six months. Whilst total net debt has risen by US505mn YoY to US$2bn in May 2022. Driving up debt levels was: (i) US$366mn increase to US$1250mn; (ii) US$70mn for the purchase of Kitchen Basics. The 40% YoY jump in inventory was due to higher cost of materials, which we believe was in preparation for a strong holiday season. We expect debt to remain elevated due to the redemption of a 6.5% US$100mn Preference Shares in Dec2022. Around 15-20% of total debt is on fixed rates.

Source: Phillip Capital Research - 12 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024