Trader Hub

City Developments Limited – Hospitality Lifts Overall Profitability

traderhub8

Publish date: Wed, 07 Dec 2022, 09:27 AM

- Copen Grand Executive Condominium (EC) fully sold within a month of launch. The recent launch of its 639-unit EC was well received. We estimate the Group achieved a comfortable ~25% profit margin on the project.

- Hospitality segment continues to benefit from pent-up demand. RevPAR surged 110% YoY, driven by increases in room rates and occupancy in Singapore, US and London.

- Maintain ACCUMULATE with unchanged RNAV-derived TP of $8.86, a 35% discount to RNAV of S$13.64. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, and faster-than-expected recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV.

The Positives

- Copen Grand EC fully sold within a month of launch. The recent launch of its 639-unit Copen Grand EC in Oct 2022, at $1,300psf, was well received and the project was fully sold within a month of launch. We estimate the breakeven price for the development to be at $1,050-$1,100psf. The price of $1,300psf therefore gives it a comfortable ~25% profit margin.

- Hospitality segment continues to benefit from pent-up demand. RevPAR surged 110% YoY, driven by a 46% increase in average room rate and 15.9% points (71% from 55.1%) increase in occupancy. Hotels in Singapore, US and Europe continued to recover faster than those in Asia, though average room rates increased across all regions, signalling a strong recovery momentum.

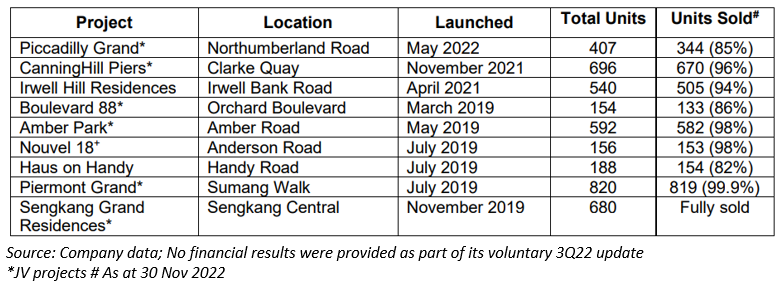

- Healthy gearing levels boost ability of the Group to replenish landbank. The Group’s net gearing levels remain stable at ~83% for 3Q22 (83% for 1H22) with interest cover at 12.1x (16.5x for 1H22). With its strong cash reserves and available undrawn committed bank facilities totalling $4bn, we believe this gives the Group sufficient capacity to replenish its landbank with its existing inventory levels now at lower levels as most of its launched projects have been substantially sold.

The Negative

- Residential sales slowed in 3Q22 as lower inventory weighed. Residential sales declined in 3Q22 as lower inventory and the absence of new launches in 3Q22 weighed. CDL sold 95 units with total sales value of $281mn vs. 414 units with total sales value of $784.4mn in the same period last year.

Source: Phillip Capital Research - 7 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments