BRC Asia – Earnings Ahead, 1H23 to be Impacted by “Heighted Safety”

traderhub8

Publish date: Mon, 05 Dec 2022, 05:48 PM

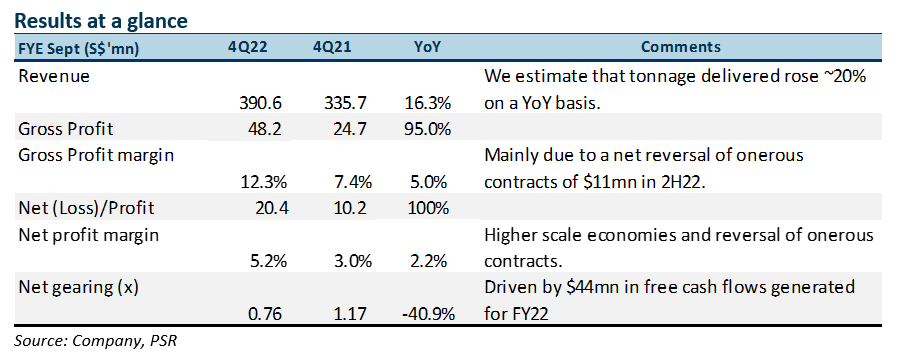

- FY22 net profit was ahead of our expectations at 112% of our FY22e forecasts. Revenue was in line at 99% of FY22e. Earnings were above expectations as higher-than-expected volume moved despite the “Heightened Safety” period imposed.

- $11mn net reversal for onerous contracts made. With steel rebar prices declining ~20% in 2H22, the Group benefitted from write-backs. GP margins improved 500bps for the period.

- Construction order book grew to $1.4bn from $1.135bn in the previous quarter. Strong demand for public housing and infrastructure projects in Singapore continued to boost the Group’s order books.

- Maintain BUY with a higher target price of S$2.30. Our TP is based on 7x FY22e P/E, lowered from 8x previously, on account of the uncertain external environment. But our TP is raised to $2.30 from $2.26 as we roll forward our valuation to FY23e. We kept FY23e earnings unchanged as we expect construction activity to continue its recovery after 1H23.

The Positives

+ FY22 net profit ahead of our expectations at 112% of our FY22e forecasts. Revenue was in line at 99% of FY22e. Earnings were above expectations as higher-than-expected volume moved despite the “Heightened Safety” period imposed by the Ministry of Manpower (MOM) from 1 Sept to 28 Feb 2023. The measures were announced after a spate of workplace fatalities since the start of the year prompted the MOM to intervene in the sector.

In view of its strong results, the Group has declared a total of 12 cents of dividends (~55% payout), comprising 6 cents final and 6 cents special dividend to reward shareholders. FY22 dividends of 18 cents represents a dividend yield of 9.8%, exceeding our 16 cents estimate.

+ $11mn net reversal for onerous contracts made. With steel rebar prices declining ~20% in 2H22, the Group benefitted from $11mn of write-backs in onerous contracts. For FY22, the Group generated a net reversal of provision of onerous contracts of $12.8mn. Correspondingly, GP margins improved 500bps for the period.

The management has guided for further reversals in onerous contracts for FY23 should steel prices remain at these levels.

+ Construction order book grew to $1.4bn (vs $1.135bn 3Q22), above our $1.2bn projections. Strong demand for public housing and infrastructure projects in Singapore continued to boost the Group’s order books. BRC Asia is benefitting from the backlog of projects that were postponed during the Covid-19 pandemic and the higher number of public housing projects that are being launched to meet demand.

The Negatives

– Construction site activity levels adversely affected by workplace fatalities and dengue. As of 1 Sept 2022, the number of workplace fatalities stands at 36 for whole of 2022, up from the 28 workplace fatalities reported for the first six months of 2022, many of which were in the construction industry. As a result of the Heightened Safety period imposed by the MOM, local construction projects are, in general, progressing slower than expected. The time-outs and punitive measures imposed on the sector has slowed construction progress.

Source: Phillip Capital Research - 5 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024