PRIME US REIT – Strong Leasing Momentum

traderhub8

Publish date: Thu, 10 Nov 2022, 06:03 PM

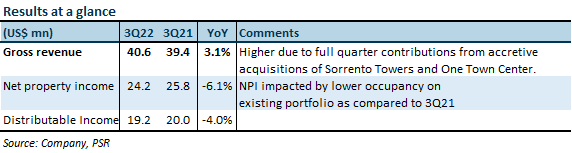

- 9M22 distributable income (+9.2% YoY) was in line, forming 73% of our FY22e estimate.

- Leasing activity in 3Q22 was close to the previous 2 quarters combined (246.2k vs 1H22 257.5k sq ft), with positive rental reversions of 10.1%. Occupancy remained stable at 89.6%.

- No change in our forecasts. Maintain BUY, DDM-TP (COE 10.55%) unchanged at US$0.88. PRIME is our top pick in the US office sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office. The current share price implies FY22e/FY23e DPU yield of 14.6/14.8%.

The Positives

+ Jump in leasing volumes. Prime signed 246.2k sq ft, or 5.7%, of portfolio CRI in 3Q22, which was close to the previous 2 quarters combined (1H2022: 257.5 sq ft). 52% of leases signed in 3Q22 were new leases, with leasing activity coming from the communications, legal services, real estate services, education and food services sectors. 3Q22 rental reversions came in at +10.1%, continuing the trend of positive rental reversions for the last 10 quarters.

+ 83% of debt is on fixed rate or hedged, with 66% of the total debt hedged or fixed through to mid-2026 and beyond. Prime has no refinancing obligations till July 2024. According to our calculations, every 100 basis points increase in interest rates would affect FY22e DPU by c.1.5%.

The Negative

– Occupancy remained flat QoQ at 89.6% for 3Q22 despite strong leasing momentum. Despite backfilling at Tower 1 at Emeryville (+18.2ppts); 101 South Hanley (+5.5ppts); and 171 17th Street (+3.1ppts), portfolio occupancy remained stable as it was dragged down by a significant non-renewal at Reston Square, bringing occupancy down from 100% to 47.1%. The tenant, Whitney, Bradley & Brown, used to occupy c.50% of space in the asset before its lease expired in July 2022.

Outlook

Leasing activity spiked up in 3Q22 with renewed efforts by companies to encourage employees back into the office. According to JLL, office re-entry levels reached a post-pandemic high in the second half of September, and remote work is showing signs of losing momentum as the labour market tightens. With in-place rents c.6.7% below asking rents, Prime’s portfolio is primed for more positive rental reversions.

Maintain BUY, DDM TP maintained at US$0.88.

No change in our TP. The current share price implies FY22e/FY23e DPU yield of 14.6/14.8%. PRIME is our top pick in the US office sector for greater tenant exposure to STEM/TAMI sectors and the resilience of its portfolio. Catalysts include improved leasing and a greater return to the office. PRIME is also trading at an attractive 40% discount to book.

Source: Phillip Capital Research - 10 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024