Venture Corporation Ltd – Revenue Close to Record Levels

traderhub8

Publish date: Mon, 07 Nov 2022, 11:52 AM

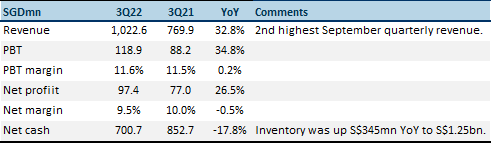

- 9M22 PAT was within expectations at 71% of our FY22e forecast. 3Q22 PAT jumped 27% YoY to S$97.4mn. The improvement was in part due to lockdowns in Malaysia a year ago.

- The company said that growth was across all sectors. We believe the strong US dollar was another tailwind to growth.

- We lift our FY22e revenue by 4% but maintain earnings as we lower margin assumptions. Our BUY recommendation and target price is unchanged at S$20.80, based on 16x PE FY22e. Venture’s dividend yield and valuation are attractive. However, we are cautious for FY23e and lower our revenue growth rate to 3% (prev. 7%). Macro uncertainty may push customers to turn cautious on their forward orders.

Results at a glance

Source: Company, PSR #Note – Only selected financials are provided in the 3Q22 update.

The Positive

+ Broad based revenue growth. Revenue growth was broad-based across all verticals. The S$1bn revenue per quarter is back to FY17 levels and the 2nd highest for a September quarter.

The Negative

– Inventory is elevated; higher effective tax. Inventory is up S$345mn YoY to S$1.25bn. The jump is to cater to rising sales demand and buffer for any supply disruptions. Another drag to earnings was the higher effective tax of 18% in 3Q22 (3Q21: 12.6%) due to lower tax incentives.

Outlook

Venture is expanding capacity in Malaysia to cater to improving demand. The trend to outsource more production into SE Asia away from China is a multi-year tailwind for Venture. However, macro uncertainty could dampen customer orders in the near term.

Maintain BUY with a unchanged TP of S$20.80

Our FY22e revenue is increase by 4% but net margins lowered on declining gross margins and higher effective tax rate.

Source: Phillip Capital Research - 7 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024