Koda Ltd – Demand Lull in the Near Term

traderhub8

Publish date: Mon, 05 Sep 2022, 05:41 PM

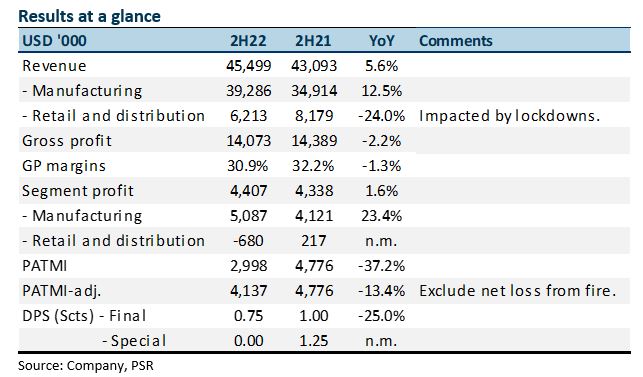

- FY22 PATMI was within expectation, excluding the losses from the Vietnam plant fire incident. FY22 revenue and PATMI were 107%/97% of our forecast. Final dividend was cut 25% YoY to 0.75 cents.

- The outlook is cautious. Furniture inventories in the US are piling up from overstocking triggered by supply chain worries and softer consumer demand which is shifting to services.

- Our FY23e earnings is cut by 54% to US$4.6mn. We downgrade our recommendation from BUY to NEUTRAL. The target price is lowered to S$0.50 (prev. S$1.10). Our TP is pegged to 5x ex-cash FY23e PE, in tandem with historical PE (ex-cash).

The Positive

+ Recovery post-lockdown in Vietnam and Malaysia. Revenue recovered significantly from the 14% YoY decline in 1H22. Operations in Vietnam and Malaysia were temporarily shut for 2 to 3 months due to COVID-19-related restrictions.

The Negatives

– Net loss of S$1.1mn from fire. 3rd January 2022, a fire incident in the Vietnam factory packaging line resulted in the loss of property, plant and equipment (US$0.6mn) and inventories (US$2.2mn) totalling US$2.86mn. Interim and partial compensation received is US$1.4mn. We estimate the net loss (after tax) to PATMI was US$1.1mn. The insurance adjusters are still in the process of determining the final claim amount.

– Retail drag in China. Due to the lockdown in China, retail sales in Commune stores were negatively impacted. Certain shopping malls were closed and consumer sentiment was weak.

Outlook

We expect 1H23 to be challenging. Customer inventories in the US are elevated and at record levels (Figure 1). With consumers shifting spending to services and discretionary spending shrunk by rising inflation, furniture demand is expected to remain weak.

Source: Phillip Capital Research - 5 Sep 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024