Singapore Telecommunications Ltd – Currency Drag This Quarter

traderhub8

Publish date: Mon, 29 Aug 2022, 11:58 AM

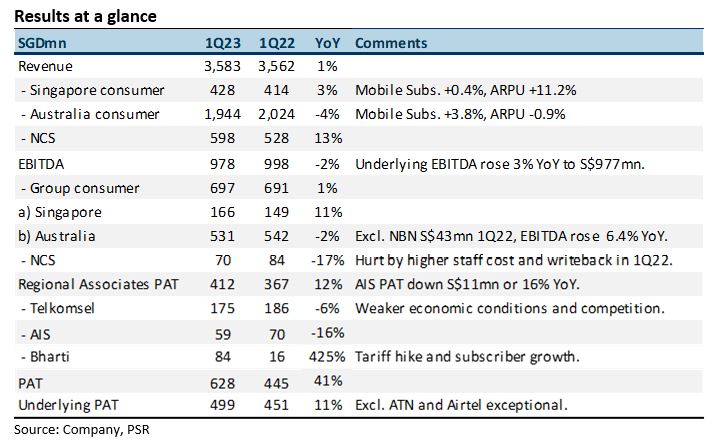

- 1Q23 results were within expectations. 1Q23 revenue and EBITDA were 24%/24% of our FY23e estimates. We removed Amobee from our forecast. It has been classified as a subsidiary for sale. There was a 4% headwind from Optus due to weaker AUD.

- 1Q23 underlying EBITDA expanded 3% YoY (or up 5% in constant currency) to S$977mn, excluding NBN migration revenue and Amobee. Regional associates’ earnings rose 12% YoY to S$411mn. The 6% depreciation in the Thai Baht and Philippine Peso also impacted earnings.

- Our FY23e PATMI is raised 5% to S$2.15bn to account for the S$129mn exceptional gain from dilution of stake in Australia Tower Network and share of Airtel revaluation of foreign currency convertible bonds. Revenue and EBITDA forecasts were modestly impacted by the removal of Amobee. Our ACCUMULATE and SOTP TP are maintained at $3.05. Singtel has also announced a 3.3% stake in Bharti Airtel worth S$2.25bn to Bharti Telecom. The gain on sale for Singtel is S$0.6bn. We view the disposal positively. It reflects the ability to realise gains from its portfolio of associates trading at a holding company discount and an opportunity for special dividends.

The Positive

+ EBITDA recovery in Singapore and Australia. Singapore consumer enjoyed a strong 11% YoY recovery in 1Q23 EBITDA. We believe roaming revenue supported an 11% YoY (and QoQ) rise in blended ARPU. Earnings drag came from TV revenue, a decline of 14% YoY. Australia enjoyed a 6% YoY improvement in EBITDA excluding NBN. We believe the reopening of borders and relaxation of movement restrictions supported mobile revenue growth.

The Negative

– Still an investment phase for NCS. Despite a healthy 13% YoY rise in revenue in 1Q23, NCS EBIT dropped 24.6% YoY. NCS is investing in higher headcount and higher staff costs which is significantly diluting margins. Group enterprise fared better with EBIT flat on a YoY basis. The pick-up in roaming, data centre and cybersecurity revenue is offset by the structural decline in voice revenue.

Source: Phillip Capital Research - 29 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024