NetLink NBN Trust – Residential Connections Normalising

traderhub8

Publish date: Wed, 17 Aug 2022, 10:11 AM

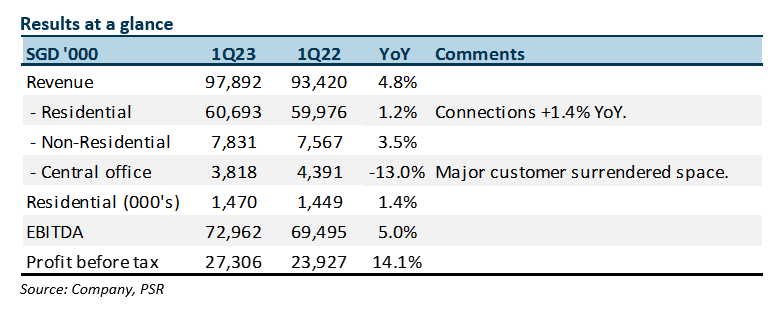

- 1Q23 revenue and EBITDA were within expectations, at 25/27% of our FY23e forecasts. Revenue rose 4.8%, supported by a sharp rebound in diversion revenue. Central office remains a drag as customers surrender more equipment space.

- Residential fibre connections rose 5,598 in 1Q23 (1Q22: +2,292). Last year was impacted by lockdowns and movement restrictions.

- Interest rate risk is well hedged, with 76% of the debt fixed at 1% until May 2026. Regulatory review of fibre prices is ongoing. Recent inflationary pressures and higher interest rates are positives. The planned capital expenditure (or regulated asset base) and WACC under consideration will be higher. No change to FY23e forecast. Our NEUTRAL recommendation and DCF target price of S$0.96 is maintained.

The Positive

+ Rebound in construction and installation activity. Residential connections are normalising post-pandemic. In the past two quarters, net connections were 11,842, triple the 3,946 a year ago. The rebound in construction and installation post-pandemic increased diversion revenue by S$1.8mn or 136% YoY. Customers in diversion include HDB and LTA.

The Negative

– Central office revenue sliding. Major customer Singtel is renting less space as less telecommunication equipment is housed in Netlink’s seven central offices. Netlink will look to alternate users for their central office space.

Outlook

On the regulatory review, we expect a mild decline in the fibre price for residential connections. It is unlikely to impact dividend payout. Higher borrowings or lower capital expenditure can tide through any near-term shortfall, in our opinion.

Our NEUTRAL recommendation is maintained with an unchanged TP of S$0.96

The modest growth in DPU reduces the attractiveness of NetLink as an income-yielding investment. NetLink’s dividend spread over bond yields and other interest-yielding assets has not widened since interest rates started to climb this year.

Source: Phillip Capital Research - 17 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024