Thai Beverage PLC – Recovery Except for Spirits

traderhub8

Publish date: Mon, 15 Aug 2022, 05:36 PM

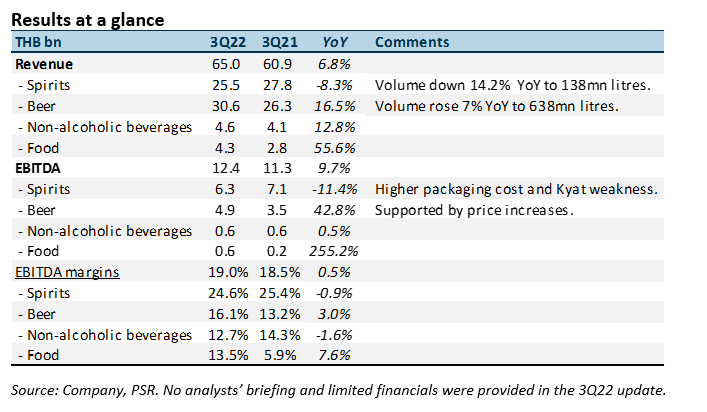

- Results are in line, with 9M22 revenue and EBITDA at 77%/76% of our FY22e forecasts.

- Spirits volumes contracted 14% YoY and margins were weaker. Beer recovered on both volume and price increases.

- We upgrade to a BUY with an unchanged target price of S$0.80 due to recent share price weakness. Our target is pegged at 18x FY22e earnings, its 5-year average. No change to our FY22e forecast. The re-opening of entertainment venues in Thailand on 1 Jun22 and softer commodity prices should support earnings in 4Q22. Separately, the company announced the deferment of the BeerCo spin-off due to challenging market conditions.

The Positive

+ Volume and price bounce for beer. Beer sales rebounded strongly with a 16% YoY growth. The volume recovery is from lockdowns a year ago, namely in Vietnam. Price increases, product mix and lower sales and marketing costs supported the expansion in EBITDA margins to a record 16.1%. Pre-pandemic EBITDA margins were around 10%.

The Negative

– Spirits down after strength a year ago. Volumes were down 14% YoY to 138mn litres. Seasonally, third-quarter volumes are the weakest. The 138mn litres is a tad above 3Q21’s 136mn litres, which included a 1-month alcohol ban in Thailand. We believe the weak volumes stem from poor sales and currency in Myanmar and lower consumption of on-premises brown spirits.

Outlook

We expect the overall recovery from lockdowns and weaker economic conditions to continue. Price increases implemented over the past few quarters together with the rolling over of commodity prices should support a gross margin recovery. Operating margins may suffer if the company resumes marketing activities that were significantly cut over the past two years.

Source: Phillip Capital Research - 15 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024