StarHub Limited – More Cost in 2H22

traderhub8

Publish date: Mon, 08 Aug 2022, 11:52 AM

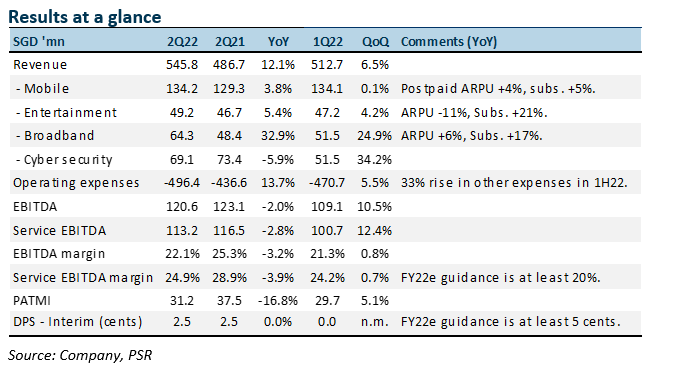

- 1H22 revenue was in line with expectations at 47% of our FY22e estimates. EBITDA beat expectation at 36%. Nevertheless, we expect margins to contract more severely in 2H22 from further investments in IT outsourcing, EPL content, software licensing and 5G wholesale cost.

- Roaming revenue is improving but below pre-pandemic levels due to a lack of business travel and border restrictions in China.

- We maintain our FY22e revenue and EBITDA forecast. We cut depreciation by S$25mn due to accelerated depreciation of legacy system in prior quarters. FY22e will be a transition year for StarHub to undertake the necessary investments into new growth areas under the DARE+. Our target price is pegged at 8x FY22e EV/EBITDA, in line with other mobile peers. Our ACCUMULATE recommendation is maintained.

The Positive

+ Exceeds guidance in multiple areas. 1H22 performance exceeded management FY22 guidance. Revenue growth (at least 10%), service EBITDA margin (at least 20%) and CAPEX (12-15% of revenue) were higher in 1H22. However, there was no change in guidance implying a much weaker 2H22. Dividend of 2.5 cents per share was within the FY22e guidance of at least 5 cents.

The Negative

– Costs start to build. Operating cost has started to climb faster. 2Q22 operating expenses increased 14% YoY to S$496mn. The bulk of the cost increase was in other operating expenses (IT outsourcing, license fees, utilities), EPL marketing and broadband acquisition. The cost is part of the DARE+ transformation plan to invest in a new revenue stream and cost savings.

Outlook

There was no change in FY22e guidance by management. We expect EBITDA margins to drop significantly from 24.6% in 1H22 to 17.4% in 2H22. Our FY22e service EBITDA margin is 20.9% vs management guidance of at least 20%. Operating expenses are expected to rise further in 2H22 from IT outsourcing, EPL content, software licensing and 5G wholesale cost. Unless roaming revenue gains further momentum or new revenue (not fully disclosed) begins to contribute meaningfully following the DARE+ investments, earnings will be sluggish in 2H22.

Maintain ACCUMULATE with an unchanged TP of S$1.35

Our target price is based on regional peers’ 8x FY22e EV/EBITDA.

Source: Phillip Capital Research - 8 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024