NetLink NBN Trust – Stable Dividends But Limited Growth

traderhub8

Publish date: Tue, 24 May 2022, 09:41 AM

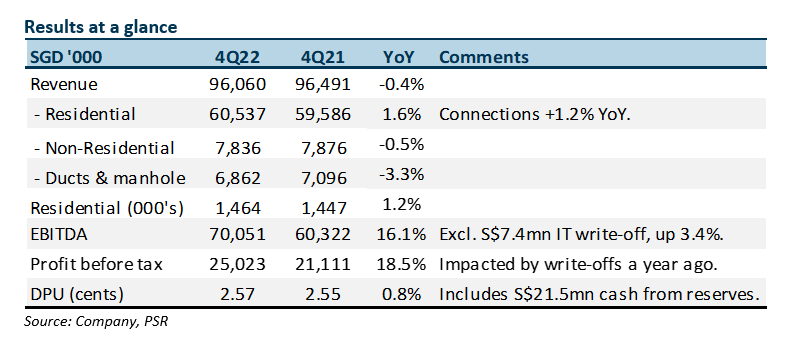

- FY21 revenue and EBITDA were within expectations, at 101/103% of our FY22e forecasts. 4Q22 revenue was flat and EBITDA up 3% YoY excluding write-offs. 2H22 DPU improved a modest 0.8% YoY to 2.57 cents.

- Residential fibre connections increased by 6,244 during the quarter. The annualised run-rate of residential connections is around our modelled 25,000 connections per annum.

- A regulatory review of fibre prices is underway. New fibre prices are to be implemented on 1 January 2023. Compared with five years ago, the regulated asset base is higher. However, the number of residential connections is one-third higher. Our forecast assumes no change in tariffs. We have kept our FY23e forecast intact. Our NEUTRAL recommendation and DCF target price of S$0.96 is maintained.

The Positive

+ Recovery in residential connections. During the pandemic, residential connections were around 15k in 2021. We have seen a significant recovery in connections, back to an annualised run-rate of 25k-26k. The lifting of COVID-19 restrictions is improving the construction of new residential homes.

The Negatives

– Ducts and manholes see multi-quarter decline. The weakest revenue segment has been the 3% reduction in duct and manhole revenues. Major customer Singtel will see less use of the ducts for their copper lines.

Outlook

The upcoming regulatory review will determine the residential tariffs for the next five years. Factors considered will be WACC, size of the regulated asset base, future capital expenditure and the number of connections. Our model assumes no change in tariff. Nevertheless, lower tariffs may impact cash available for distribution. However, there are other levers to maintain near-term dividends such as higher borrowings or lower capital expenditure.

We maintain our NEUTRAL recommendation with an unchanged TP of S$0.96

We expect distribution per unit to be stable. The continuous rise in interest can taper the attractiveness of the distribution as earnings growth will be limited.

Source: Phillip Capital Research - 24 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024