Prime US REIT – Healthier Leasing Demand

traderhub8

Publish date: Mon, 23 May 2022, 09:41 AM

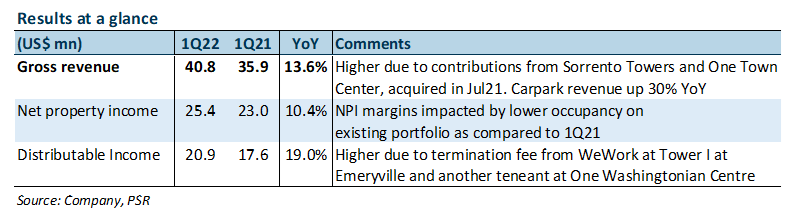

- 1Q22 distributable income (+19% YoY) was in line, forming 25% of our FY22e estimate. It was lifted by the acquisition of Sorrento Towers and One Town Center in Jul2 and higher carpark income.

- Leases signed jumped 80% QoQ; 172k sq ft was signed at +3.4% reversions. Backfilling at Crosspoint (+5.4ppts) and 222 Main (+3.7ppts) was offset by non-renewals resulting in 0.4ppt decline in portfolio occupancy to 89.9%

- Upgrade from ACCUMULATE to BUY, DDM-TP (COE 9.6%) raised from US$0.94 to US$1.00 as we roll forward our forecast. Our COE nudged up from 9.5% to 9.6% on higher risk-free rate assumption. Prime is our top pick in the sector for greater tenant exposure to STEM/TAMI sectors. Catalysts include improved leasing and a greater return to office.

The Positive

+ Jump in leasing volumes. Prime signed 172k sq ft or 3.9% of portfolio NLA in 1Q22. This was 80% higher QoQ; 32% of which were new leases. 1Q22 reversions came in at +3.4% compared to +9.8% in 4Q21. Some new leases were signed on space that had been vacant for more than 12 months, and hence are excluded from reversion calculations. The management said that leasing demand was stronger across its market and observed deeper tenant interest lists. Prime signed 46k sq ft of leases post quarter, bringing YTD reversion to c.6%.

The Negative

– Non-renewals chipping away at occupancy. Portfolio occupancy dipped QoQ from 90.3% to 89.9% despite backfilling at Crosspoint (+5.4ppts) and 222 Main (+3.7ppts). Portfolio occupancy was dragged down by a significant non-renewal at Tower I at Emeryville, bringing occupancy down from 70.4% to 58.9%. Five out of 14 assets have committed occupancies below 90% and require backfilling. Prime will continue to recognise pre-termination income for WeWork’s space at Tower I at Emeryville until early-4Q22 and for another pre-termination at One Washingtonian Centre until 3Q22. This could result in potential upside for Prime should it be able to lease out the space before the pre-termination fee runs out. Prime has also started marketing the space for a known non-renewal at Reston Square. The tenant, Whitney, Bradley & Brown, occupies c.50% of space in the asset and will be vacating its lease when it comes due in Jul22.

Outlook

Leasing activity picked up in 1Q22 with a broader tenant list and interest coming from small, medium and large space users across more industries. With expiring rents c.6% below asking rents, Prime’s portfolio is primed for more positive rental reversions.

Source: Phillip Capital Research - 23 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024