CapitaLand Investment Limited – Tracking Our Forecast

traderhub8

Publish date: Tue, 17 May 2022, 11:44 AM

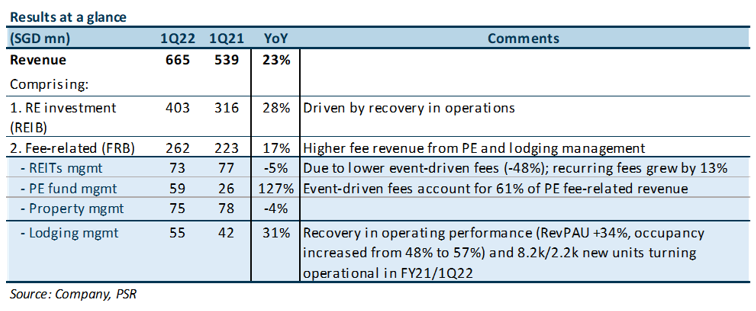

- 1Q22 revenue of S$665m (+23% YoY) was in line, forming 25% of our forecast.

- RE investment revenue grew 28% YoY, driven by broad-based recovery. Fee-related revenue was up 17% YoY, lifted by PE fund management (+127%) and lodging management (+31%).

- Maintain ACCUMULATE, SOTP TP raised from S$4.05 to S$4.12. We raise our FY22e PATMI estimate from S$1,218 to SS$1,234 on higher fund management margins. Our SOTP TP raised due to higher investment management PATMI. The pick-up in travel and lifting of lockdowns in China are immediate catalysts for CLI.

The Positives

+ Fund management fee-related revenue (+28% YoY) formed 20% of revenue. PE fees (+127%) were boosted by higher transaction-related fees, which formed 61% of PE fees, while recurring PE fees grew 21% YoY. Notable transactions include the unwinding of CLI-managed CapitaLand Vietnam Commercial Value-Added Fund (CVCVF) in Jan 22 and reduction in equity stake in Athena LP in Feb 22, which realised IRRs 200% and 60% above their respective project IRRs and generated transaction fees. Post-quarter, the PE fund holding 79 Robinson Road divested the asset to CapitaLand Integrated Commercial Trust (CICT SP, BUY, TP: S$2.46) and another CLI-managed PE fund, COREF, realising c.S$72mn in divestment gains. CLI’s listed funds posted +13% and -48% growth in recurring and transaction-related fees. The latter was the result of a high base in 1Q21, as transactions picked up after the pandemic year.

+ Lodging segment recovering steadily. Lodging management fees rose 31% on recovering operating performance as well as 8.2k/2.2k new units turning operational in FY21/1Q22. RevPAU grew +34% as average daily rates grew 14% and portfolio occupancy increased from 48% to 57%. Recovery was seen across all CLI’s key markets, except China, with strongest RevPAU recovery in Europe (+168%) and Singapore (+40%). The group also signed 3.2k keys during the quarter, c.24.7% the number of keys signed in FY21, bringing the number of keys signed to 135k.

+ Real estate investment business (REIB) grew 28% YoY, on the back of reopening in most of CLI’s markets, with the exception of China and Japan. Significant easing of community safe management measures since Mar 22 has improved business and consumer sentiment and increased activities. Leasing activity in India has similarly picked up with physical occupancy at business parks improving to 15-30% from <5% in FY21. Due to China’s zero COVID-19 policy, Shanghai was placed under lockdown since Mar 22 due to the spike in COVID cases. This has stalled leasing activity and will likely result in some rental rebates given to affected tenants in 2Q22, in line with the PRC government’s messaging to its state-owned enterprises. For context, 15 of CLI’s assets are in China, representing 34% of its China exposure.

The Negatives

– Macro-economic and geopolitical headwinds slowing fund generation and acquisition momentum. Inflation, rising interest rates and the ongoing Russia-Ukraine conflict has resulted in a more circumspect behaviour and higher required returns for capital investors, limiting the assets eligible to seed funds. While USD-denominated capital has taken a wait-and-see approach towards RMB investments, CLI’s RMB fund management license allows it to tap local capital. However, lockdowns and tightened restrictions in Shanghai and Beijing have impeded business discussions and may delay planned transaction if lockdowns persist.

Outlook

CLI’s real estate investment and lodging management business should continue to recover on the back of further easing of travel and mobility restrictions. Having divested S$1.6bn YTD, CLI is on track to hitting its annual divestment target of S$3bn. However its 10% FUM growth target may be at risk given the current macro-economic and geopolitical headwinds which have resulted in more circumspect behaviour amongst capital investors. Prolonged lockdowns in Shanghai and Beijing may also delay planned transactions.

Maintain ACCUMULATE; SOTP TP raised from S$4.05 to S$4.12

We raise our FY22e PATMI estimate from S$1,218 to SS$1,234 on higher fund management margins. The SOTP TP is up due to higher investment management PATMI. The pick-up in travel and lifting of lockdowns in China are immediate catalysts for CLI.

Source: Phillip Capital Research - 17 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024