Keppel DC REIT – Earnings Cushioned by Recent Investments

traderhub8

Publish date: Thu, 21 Apr 2022, 03:33 PM

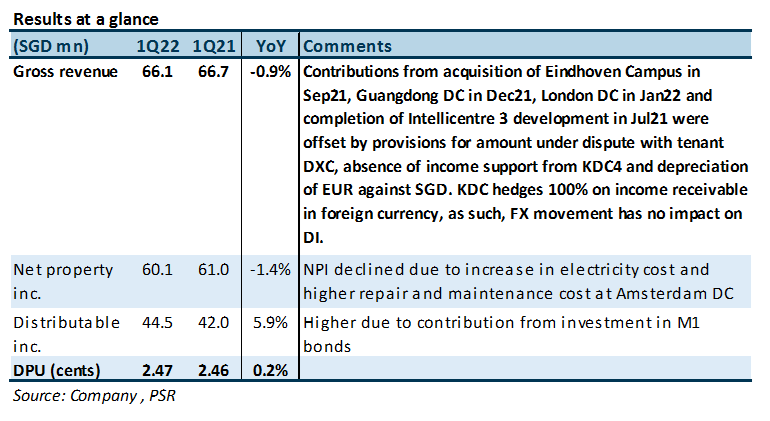

- 1Q22 DPU of 2.466 Scts (+0.2% YoY) was in line, forming 24.9% of our FY22e forecast.

- Contributions from investments in Eindhoven DC, Guangdong DC, London DC and NetCo bonds totalling c.S$386mn, and completion of AEI at DC1 and Intellicentre3 development were wiped out by higher electricity costs, provision for litigation and absence of rental support for KDC4.

- Maintain BUY on earnings stability and attractive entry price for future-ready DC assets. FY22-26e DPUs lowered by 3.7-6.1% due to provision for litigation and higher electricity costs, resulting in 8.2% reduction in our DDM-TP (COE 5.88%) from S$2.81 to S$2.58. The current share price implies FY22e/23e DPU yields of 4.7%/4.8%.

The Positive

+ Portfolio occupancy up 0.4ppts YoY, from 98.3% to 98.7%. This was due to higher occupancy at DUB1, which improved from 82.3% to 95.9%. KDC also renewed its lease at Basis Bay, extending the the weighted average lease expiry (WALE) at the property from 0.2 years to 4.7 years. While committed occupancy was not disclosed, we understand from the management that the tenant has downsized its space. Occupancy at Basis Bay is expected to decline from 63.1% when the new lease kicks in. Portfolio WALE lengthened from 7.5 years to 7.7 years.

The Negatives

– Litigation against DXC over revenue for provision of colocation services. KDC announced its litigation against DXC on 21 March 2022. The suit, which was initiated by KDC, was for c.S$14.8mn in colocation service revenue in connection with provision of facility management services at KDC1 for the 4-year period between 1 April 2021 and 31 March 2025. The affected occupancy is c.0.4% of KDC’s NLA as at 31 December 2021, and the impact arising from the disputed sum per annum is approximately 2.0% of FY21’s distributable income.

– Slight increase in cost of borrowing and gearing. Cost of borrowing remains low despite increasing from 1.6% to 1.8%. Portion of debt on fixed rates crept up from 74% to 76% while gearing inched up slightly from 34.6% to 36.1% post-acquisition of London DC but remains below the 50% regulatory limit.

Outlook

About 17.1% of leases are due to expire in FY22, likely from KDC4 given the short WALE of 0.4 years. While the data centre moratrium in Singapore has been lifted, construction of new supply is expected to take 2-3 years to come online. Tenant stickiness is high due to the significant cost of relocation. We remain optimistic about KDC’s tenant retention ability over the mid-term.

Including the acquisition of London DC, KDC’s AUM grew 16.7% since Dec 20. Data centre cap rates were stable QoQ. KDC continues to source for acquisitions in Asia, Europe and US, with a preference for off-market deals which could provide better entry yields. KDC also has a ROFR on the remaining five data centres located within the Bluesea Intelligence Valley from the vendor of Guangdong DC.

Maintain BUY with a lower DDM TP of S$2.58 (prev. S$2.81)

FY22-26e DPUs lowered by 3.7-6.1% due to provision for litigation and higher electricity costs, resulting in 8.2% reduction in our DDM-TP from S$2.81 to S$2.58. The current share price implies FY22e/23e DPU yields of 4.7%/4.8%.

Source: Phillip Capital Research - 21 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024