Del Monte Pacific Limited -Temporary Dip in Margins

traderhub8

Publish date: Tue, 15 Mar 2022, 09:14 AM

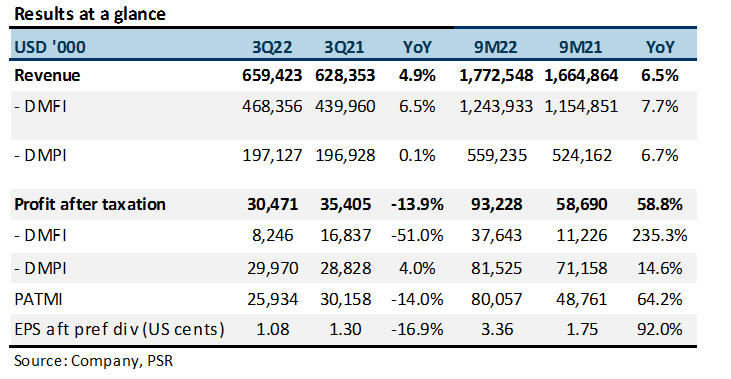

- 3Q22 results exceeded expectations. 3Q22 revenue and PATMI at 28%/29% of our FY22e forecasts. Revenue from Americas exceeded expectations, but gross profit lower than expected due to inflationary pressures.

- US subsidiary DMFI sales grew 6.5% YoY, mainly supported by branded retail core canned vegetable and fruit and food service channels.

- DMPI saw sales of S&W branded business increase 11.2% YoY, mainly driven by higher sales of S&W fresh pineapple in North Asia and Singapore, and higher prices to counter inflation.

- Maintain BUY with a higher TP of S$0.63, from S$0.62. We raise FY22e PATMI by 7.5%, as we lower our forecasts for operating and interest expenses, in line with the trend for 9M22. Our TP is now pegged to 12x FY22e P/E, down from 13x. We still apply a 20% discount to the industry valuation, which is now 15x, down from 16x.

The Positives

+ US subsidiary Del Monte Foods Inc (DMFI) sales in 3Q22 increased 6.5% YoY. In the Americas, sales increased by 6.3% YoY to US$471.3mn due to higher sales from branded retail (+2.5% YoY) primarily core canned vegetable and fruit which more than offset planned reduction in private label sales. With the re-opening of schools and restaurants, sales from the food service channel grew significantly by 48% YoY.

+ Del Monte Philippines Inc (DMPI) in 2Q22 supported by both local and international sales. Asia Pacific sales increased 4.1% YoY to US$181.5mn. S&W branded business increased 11.2% YoY, driven by higher sales of fresh pineapples due to increase in volume in North Asia and Singapore, expanded distribution in China as well as price increases to counter inflation. In peso terms, sales in the Philippines rose 4.2%. Some growth was seen across almost all categories despite continued lockdown and lower foot traffic due to the pandemic, proving the strength of Del Monte’s market leader position in the Philippines.

The Negative

– Inflationary pressures. US subsidiary DMFI saw profit after tax falling 51% YoY despite higher sales, due to higher manufacturing cost driven by commodity headwinds, weather-related events and freight headwinds, particularly ocean freight on co-pack products, which more than offset higher sales. Gross margins declined 3.5 ppts to 20.9%. On 9M basis, gross margin was up 1.4 ppts to 23.6%.

Other updates

Improving cost of debt in the long term. DMFI issued US$500mn of 11.875% Senior Secured Notes on 15 May 2020. They will mature on 15 May 2025 and are redeemable at the option of DMFI beginning in May 2022. Interest paid under this loan in FY21 was US$29.7mn, accounting for 27% of total interest expense. Due to the one-time estimated US$45m cost of early redemption, we will only see the effect of net savings on this loan in FY24 (Figure 1).

DMPL announced that they will be redeeming all the outstanding US$200mn Series A-1 Preference Shares, which we expect the company to refinance through loans. This would increase interest expense, but net savings are expected as the new loans would be taken at lower rates. DMPL recently issued US$90mn 3-year unrated Senior Notes with fixed coupon rate of 3.75% payable semi-annually. This compares to fixed rates of 6.625% and 6.5% per annum for Series A-1 and A-2 preference shares respectively.

In October 2021, S&P Global Ratings raised the credit rating on DMFI to ‘B’ from ‘B-‘, and issue-level rating on its debt to ‘B’ from ‘B-‘. In January 2022, Moody’s upgraded DMFI’s Corporate Family Rating to B2 from B3. We expect DMFI to issue debt at a lower cost.

Source: Phillip Capital Research - 15 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024