CapitaLand Investment Limited – Commendable Recycling and FUM Growth

traderhub8

Publish date: Tue, 08 Mar 2022, 09:34 AM

- than forecasted performance of JV & Associates, valuation recovery and portfolio gains.

- FY21 DPS of 15 Scts was a positive surprise, exceeding our DPS forecast of 8.3 Scts. DPS comprised 12 Scts of ordinary and 3 Scts of special dividends. Core and total dividends formed 55% and 70% of FY21 cash PATMI respectively.

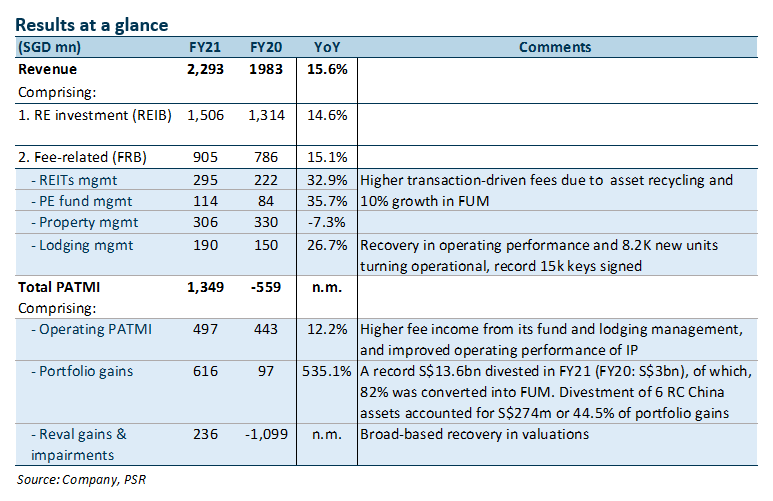

- Earnings bolstered by portfolio gains from a record year of divestment, higher transaction-driven fees, 8.2k lodging units turning operational and recovery in operations.

- Maintain ACCUMULATE, SOTP TP raised from S$4.00 to S$4.05. SOTP TP increases as we raise FY22e investment management PATMI to factor in faster FUM growth as well as higher EBITDA from the lodging segment.

The Positives

+ Stellar year of capital recycling; driving 9M21 fee-related earnings (+34%) and funds under management (+10%). CLI divested S$13.6bn in FY21 at an average 13.1% premium to book value, crystalising S$616mn in portfolio gains. This was 4.5x higher than the S$3.0bn divested in FY20 and higher than the 8-10% premium CLI has achieved in the last 3-5 years. c.82% of divestments were converted into FUM, helping CLI to achieve its 10% p.a. FUM growth target. CLI incepted seven new private funds in FY21, raising more than S$1.4bn from external parties. Fee-related earnings (FRE) grew 34% YoY to S$409mn, bolstered by transaction-driven fees which accounted for 18% of FRE. Recurring earning accounted for the remaining 82% of FRE, which grew 17% YoY. Capital recycling also allowed CLI to rebalance its portfolio into new economy assets. c.70% of assets divested were integrated development assets, while 56% of S$6.8bn in investment were in new economic assets, which include data centres, business parks and logistics assets.

+ Lodging segment recovering steadily. RevPAU rose 19% YoY, as occupancy improved to c.60%, up from c.50% in FY20. Revenue from the lodging segment grew 27%, on the back of recovery in operations and 8.2k keys turning operational. CLI signed 15k new keys, up from 14k keys signed in FY20, growing the number of keys under management by 8% to 133k keys. CLI is on track to meet its FY23 target of 160k keys under management.

+ China showing recovery; Singapore stabilising. Occupancy across retail, office and new economy assets in China improved 3-4ppts YoY on the back of sustained reopeneing. Occupancy at Singapore retail and office assets fluctuated 1-2ppts YoY, still impacted by the periodic tightening of restriction. Occupancy at new economy asset was up 2ppts with positive reversions recrossed across multiple asset types.

The Negatives

– Occupancy in India business and logistic parks dipped 8ppts YoY from 93% to 85%. While presented as one of CLI’s core markets, India represents <3% of CLI’s FY21 EBITDA. CLI secured positive reversions on leases signed during the year, however, occupancy in India business and logistic parks dipped 8ppts YoY. This contrasts with the improving occupancy seen across the new economy assets in China and Singaopore, which saw occupancy improve 3ppts to 94% and 90% respectively.

Outlook

CLI’s property portfolio continues to recover on the back of a reopening and return-to-normalcy. CLI maintains its S$3bn p.a. divestment target while growing FUM by 10% p.a.. At current growth rates, CLI is on track to hitting its 2023 lodging target of 160k keys under management and S$100bn 2024 FUM target. This will increase the proportion of fee-related earnings for CLI, which currently account for 40% of operating PATMI.

As CLI pushes to grow PE FUM, new funds will adopt a traditional PE fee structure which includes an ongoing management fee based on committed capital as well as carry fees which are tied to the performance of the fund manager. As CLI’s private fund business is less established compared to its track record as a manager of listed funds, CLI is prepared to take up to a 20% stake in newly incepted private funds as a show of confidence and alignment of interest with its third-party equity providers.

Source: Phillip Capital Research - 8 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024