StarHub Limited – Upfront Investments to Drag FY22e Earnings

traderhub8

Publish date: Mon, 14 Feb 2022, 10:28 AM

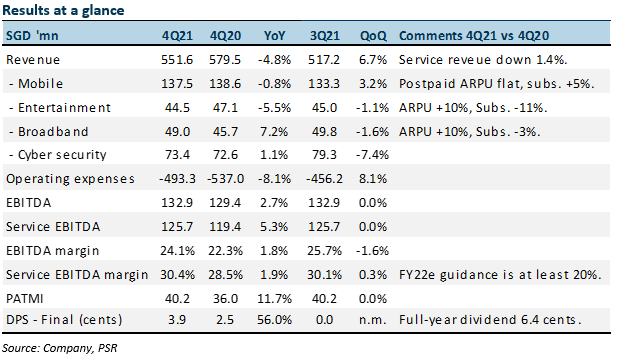

- 4Q21 revenue met our expectations. EBITDA beat estimates at 109% of our FY21 forecast.

- Operating expenses declined 8% YoY in 4Q21 led by lower content cost, dealer commissions, marketing and staff cost. FY21 FCF was a record $485mn.

- StarHub guided a steep decline in service margins from 30% in FY21 to at least 20% in FY22e. StarHub will be investing in technology OPEX, staff cost and maintenance for its transformation road map of growth (DARE+). Another trigger for higher cost is electricity expenses. CAPEX to sales will rise from 4% to 12-15% of sales.

- We cut FY22e EBITDA by 22%. The NEUTRAL recommendation is maintained with a higher target price of S$1.35 (previous S$1.24). Our valuation is raised from 6x to 8x FY22e EV/EBITDA due to appreciation in peer valuation. We raised mobile ARPU expectations by 14% for FY22e as roaming revenue begins to normalise.

The Positives

+ Transformation-led cost controls. Service EBITDA margin of 30% for FY21 beat our expectations of 26% and guidance of at least 26%. 4Q21 experienced a significant 8% YoY decline in operating expenses to S$493mn. We believe StarHub’s transformation efforts to realign pay TV programming and digitalise processes resulted in lower content cost, dealer commissions and staff cost.

+ Record FCF supported dividends. FCF generated in FY21 was a record $485mn, a $97mn YoY improvement. A combination of higher operating cash-flow and lower CAPEX drove the improvement in FCF. Final dividend declared was 3.9 cents, up 56% YoY. Full-year dividend of 6.4 cents exceeds our forecast of 5 cents. Guidance was at least 5 cents or 80% payout ratio.

The Negatives

– Lack of revenue growth. Service revenue declined 1.4% YoY in 4Q21. Dragging down revenues were network solutions (-9%), mobile (-1%) and entertainment and modest growth in cybersecurity. ARPU for mobile was flat YoY despite 300,000 5G subscribers (or 20% of postpaid). The absence of roaming remains a major headwind.

– Cybersecurity still in investment mode. FY21 revenue for cybersecurity (Ensign and D’Crypt) jumped 22% YoY to S$268mn. However, EBITDA declined by 7% YoY to S$25.5mn. Net profit almost halved to S$1.7mn. Profitability was impacted by an inventory write-off of S$4.2mn in 2H21.

Outlook

StarHub has made tremendous headway in removing fixed cost. Over the past three years, service revenue from legacy businesses (excluding cyber-security and regional ICT) has declined by almost S$500mn, whilst EBITDA only dropped S$54mn. Aggressive cost initiatives have supported earnings. The major decline in fixed costs over the past three years are staff cost (-S$86mn), operating leases (-S$80mn) and cost of services (-S$126mn). Cost of services includes content cost and dealer commissions.

With most of the cost restructuring almost completed, StarHub needs to invest for growth (DARE+ FY22-26 growth roadmap). The current upfront investments in technology and staff are to further digitalise its internal platforms and 5G network. After the completion of these investments, profit opportunities are S$220mn and cost savings S$280mn, as guided by management. Some revenue opportunities after the transformation include cloud gaming and 5G solutions for the enterprise market.

Source: Phillip Capital Research - 14 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024