Singapore Banking Monthly – Interest Rates Down in January

traderhub8

Publish date: Wed, 09 Feb 2022, 12:43 PM

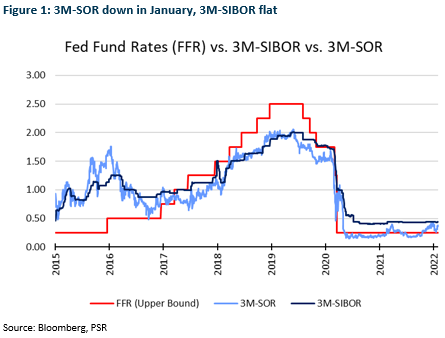

- January’s 3M-SOR down MoM, 3M-SIBOR remains flat.

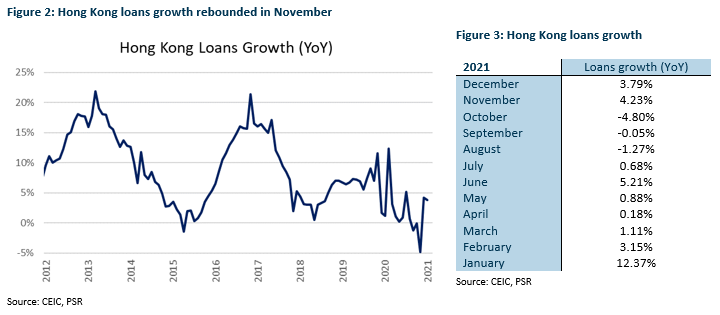

- Hong Kong’s domestic loans growth increased 3.79% YoY in December. Malaysia’s domestic loans growth increased 4.51% YoY and rose 0.53% MoM in December.

- Our 4Q21e PATMI estimates are: DBS (S$1.4bn), UOB (S$1.3bn) and OCBC (S$1.1bn). Valuations for OCBC are the most attractive and largest upside surprise from dividends.

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive with upside surprise due to excess capital ratios. Improving economic conditions and rising interest rates remain tailwinds for the banking sector. SGX is another beneficiary of higher interest rates.

3M-SOR down slightly in January, 3M-SIBOR remained flat

Interest rates were down slightly in January. The 3M-SOR was down 5bps MoM to 0.32% while the 3M-SIBOR remained flat MoM at 0.44%. The 3M-SOR is 1bps higher than its 4Q21 average of 0.31% and has improved by 12bps YoY. The 3M-SIBOR is flat against its 4Q21 average of 0.44% and has improved by 4bps YoY (Figure 1).

Hong Kong and Malaysia loans growth continued in December

Hong Kong’s domestic loans growth increased to 3.79% YoY, but fell by 0.84% MoM in December. The loans growth for December showed a slight dip from the previous month, but it was still the fourth highest positive loans growth YoY recorded for 2021.

Malaysia’s domestic loans growth saw an increase of 4.51% YoY in December and rose 0.53% MoM in December. The increase YoY in December was the highest recorded since May 2019.

Source: Phillip Capital Research - 9 Feb 2022

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024