Keppel DC REIT – Valuations Speak for Fundamentals

traderhub8

Publish date: Thu, 27 Jan 2022, 03:58 PM

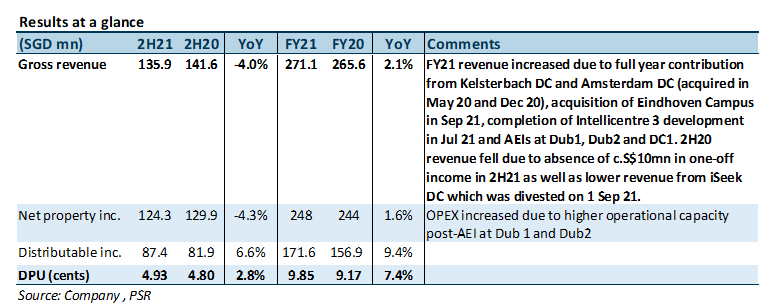

- FY21 DPU of 9.851 Scts (+7.4% YoY) was in line, forming 100.3% of our forecast. FY21 revenue increased due to acquisitions, completion of redevelopment at Intellicentre 3 and various AEIs in Ireland and Singapore.

- S$386mn in investments made in FY21 could provide more than 4% in DPU accretion for KDC.

- Maintain BUY on earnings stability and attractive entry price for future-ready DC assets. FY22e-25e have been lowered by 0.9-4.1% on the anticipated rising cost of borrowing. Our DDM-based TP dips from S$3.03 to S$2.81 on lower DPU estimates and assumption of higher cost of equity of 5.88% (previous 5.75%). The current share price implies FY22e/23e DPU yields of 4.8%/4.9%.

The Positives

+ Portfolio occupancy up 0.5ppts YoY, from 97.8% to 98.3%. This was due to the acquisition of fully-leased Guangdong DC and occupancy improvements at KDC1 and Dub1. Occupancy at KDC1 inched up 2.0ppts to 93.1%, while occupancy at Dub1 saw a 1.1ppt improvement, at 82.3%.

+ Portfolio valuation up 8.9%, or S$213mn, on a same-store basis, largely driven by cap rate compressions. Singapore properties accounted for 83% of the valuation uplift, with cap rate range compressing approximately 55-82bps YoY, from 4.95%-10.12% to 5.25%-9.31%. Intellicentre Campus in Australia accounted for 17% of the valuation uplift after the TOP of Intellicentre 3 in Jul 21, while Cardiff DC in the UK took a 7% haircut owing to more conservative assumption following a change of valuer.

+ S$386mn in investments to secure FY22 DPU growth. KDC announced S$386mn in investments in FY21 which carry an average EBITDA yield of 7.1% (Figure 1). Given the timing of legal completion, these investments will contribute more meaningfully towards FY22 earnings.

The Negative

– KDC4 and Basis Bay DC leases ticking down to expiry. 18.7% of leases by GRI are up for renewal in FY22, likely from KDC4 and Basis Bay DC given the shorter WALEs of 0.7 years and 0.5 years at these assets. The manager is still in the midst of renewal discussions but remains open to divesting if offer prices are compelling.

Source: Phillip Capital Research - 27 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024