Singapore Banking – Time for OCBC to Catch Up

traderhub8

Publish date: Fri, 21 Jan 2022, 10:36 AM

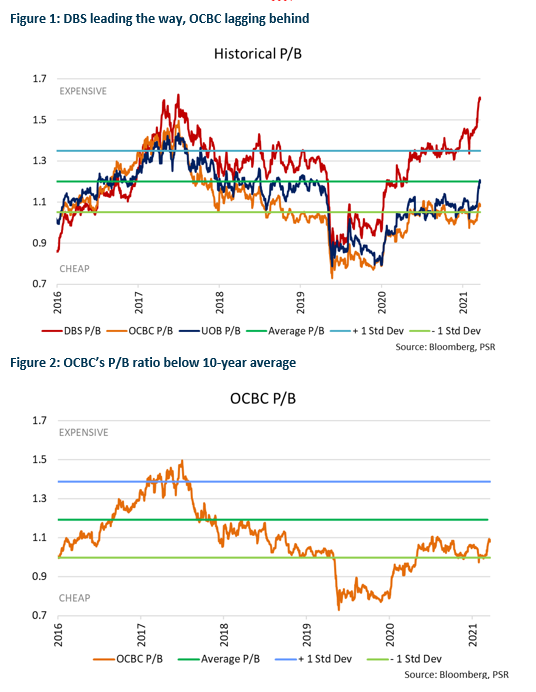

- DBS’ P/B ratio at record high while OCBC is lagging behind.

- OCBC’s P/B ratio below its 10-year average

- UOB’s P/B ratio at its 10-year average

- Maintain OVERWEIGHT. We remain positive on banks. We prefer OCBC due to its potential upside of 15.6%. OCBC will also be a beneficiary of rising interest rates, and there is also potential for higher dividends due to its higher CET1 ratio.

DBS way ahead while OCBC lags behind

DBS’ current Price to Book (P/B) ratio of 1.6x is at a record high and is 0.4x higher than the 10-year average P/B ratio of the three local banks of 1.2x (Figure 1). Meanwhile, UOB’s P/B ratio is at the 10-year average, while OCBC is lagging behind with a P/B ratio of 1.1x which is only slightly above the -1 standard deviation (s.d.) (Figure 2).

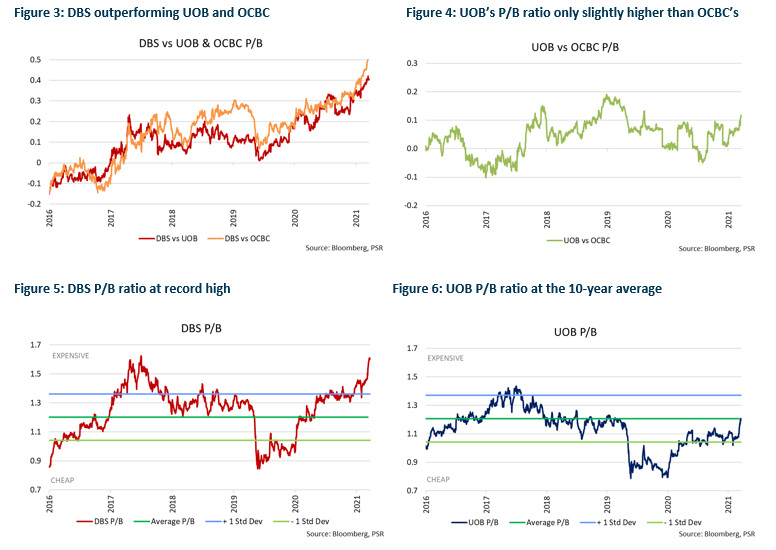

Time for OCBC to catch up

DBS’ share price is at an all-time high, with the difference between DBS’ P/B ratio and UOB’s and OCBC’s P/B ratio at a record high of 0.4x to 0.5x (Figure 3). However, UOB’s P/B ratio when compared to OCBC’s is relatively moderate, hovering at a difference of only 0.1x (Figure 4). DBS’ P/B ratio is currently way above the +1 s.d. and is at a record high (Figure 5), while UOB’s P/B ratio is at its 10-year average (Figure 6).

Source: Phillip Capital Research - 21 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024