Asian Pay Television Trust – 2022 Dividends Maintained

traderhub8

Publish date: Mon, 15 Nov 2021, 10:06 AM

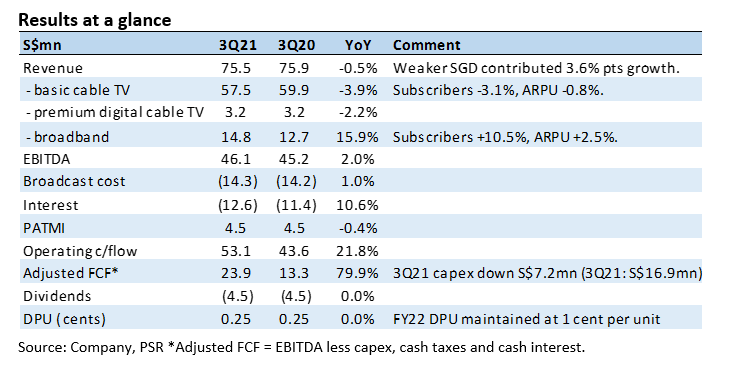

- 3Q21 results met our expectations. 9M21 revenue and EBITDA at 74%/77% of our FY21e forecasts. The company guided that FY22 DPU will be maintained at 1 cent.

- 3Q21 free cash-flows of S$24mn supports the quarterly dividend payout of S$4.5mn and dividend yield of 7.4%.

- Our FY21e forecast and target price of S$0.15 is maintained. Valuations of 9x FY21e EV/EBITDA are a 20% discount to Taiwanese peers on account of its smaller scale and higher leverage. We downgrade our recommendation from BUY to ACCUMULATE due to the recent share price performance. Growth in broadband and lower capital expenditure is offsetting the weakness in key basic cable TV revenue. Another catalyst will be 5G data backhaul revenue from mobile operators.

The Positives

+ Free cash-flows grew due to lower capex. Free cash-flows generated was $24mn, providing sufficient support to the quarterly dividends of S$4.5mn. Growth in cash-flows stemmed from the S$10mn decline in capital expenditure and stable EBITDA.

+ Broadband revenue growth accelerating. 3Q21 broadband net adds in subscribers was a record 10,000 to 274,000. Attractive pricing plus partnerships with various mobile operators helped. The rise in net adds was accompanied by an improvement in ARPU. Joint marketing with mobile operators has allowed APTT to widen their pool of customers. Mobile operators can sell bundled plans with APTT fixed broadband.

The Negative

– Core cable secular weakness intact. Cable TV subscribers have been on a decline for more than 15 quarters. The main factors are piracy, aggressive IPTV prices and a saturated cable TV market.

Outlook

Despite improving cash-flows, APTT will maintain DPU at 1 cent for FY22. The focus is to reduce borrowings and refinance the more expensive offshore debt (interest margin 4.1% to 5.5%) with onshore facilities as net debt to EBITDA metrics improve.

Downgrade from BUY to ACCUMULATE with an unchanged target price of S$0.15

Our downgrade in recommendation is due to the recent share price appreciation. APTT pays an attractive dividend yield of 7.4% well supported by cash flows.

Source: Phillip Capital Research - 15 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024