StarHub Limited – Stable With Roaming + Cybersecurity Optionality

traderhub8

Publish date: Mon, 15 Nov 2021, 09:57 AM

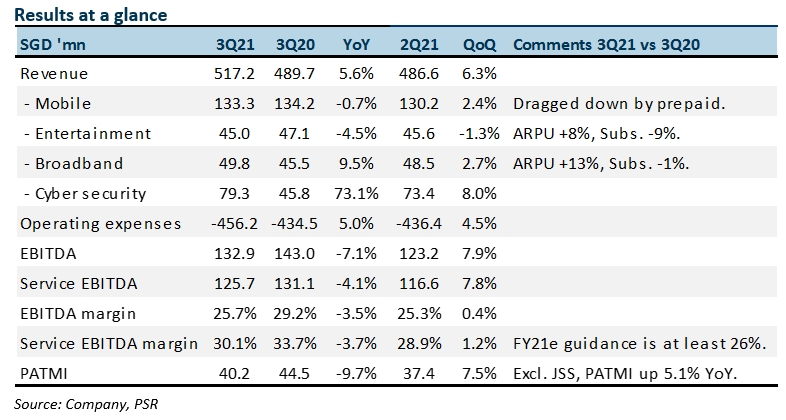

- 3Q21 results met our expectations. 9M21 revenue and EBITDA were at 72% and 80% of our FY21e forecasts respectively.

- Broadband and entertainment revenue trending ahead of our estimates due to increase in ARPUs. Mobile remains weak, dragged down by large churn in prepaid subscribers.

- 3Q21 cybersecurity operating profits more than doubled from S$2.8mn to S$5.8mn.

- No change to our forecasts. We maintain NEUTRAL with an unchanged target price of S$1.24. Valuations based on regional peers’ 6x FY21e EV/EBITDA. Starhub pays a stable 4% dividend yield with undervalued optionality in roaming and cybersecurity. There is upside to our target price if borders re-open faster, allowing roaming revenue to return. Another re-rating catalyst is sustained earnings from the cybersecurity operations or a corporate exercise for higher price discovery.

The Positives

+ Surge in operating profit in cybersecurity. 3Q21 revenue jumped 73% YoY to S$79mn. Operating profits spiked from S$2.8mn to S$5.8mn. The quarterly revenue run-rate improved from around S$40mn to S$70mn. There is revenue volatility due to project timing. But underlying demand is secular due to consistent threat intrusions, cyber-attacks and outsourcing of cybersecurity needs to established organizations such as Ensign.

+ Rising ARPU in broadband. ARPU jumped 13% YoY to S$34 on the back of reduced legacy promotions and higher 2GBps data plans with OTT bundles.

The Negative

– Mobile revenue is still soft. The loss of roaming revenue has capped postpaid ARPU at S$29, almost 30% below pre-pandemic S$40 (excluding the impact of SIM-only plans). This quarter experienced a huge 50k churn out of prepaid customers to 458k subscribers.

Outlook

Border re-opening especially in Malaysia and China will be key drivers for roaming revenue to return. Dividend guidance of a minimum of 5 cents per share or at least 80% PATMI is maintained.

Maintain NEUTRAL and TP of S$1.24

Our valuation remains based on regional peers’ 6x FY21e EV/EBITDA.

Source: Phillip Capital Research - 15 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024