CapitaLand Investment Limited - Capital Recycling and Recovery

traderhub8

Publish date: Mon, 08 Nov 2021, 06:34 PM

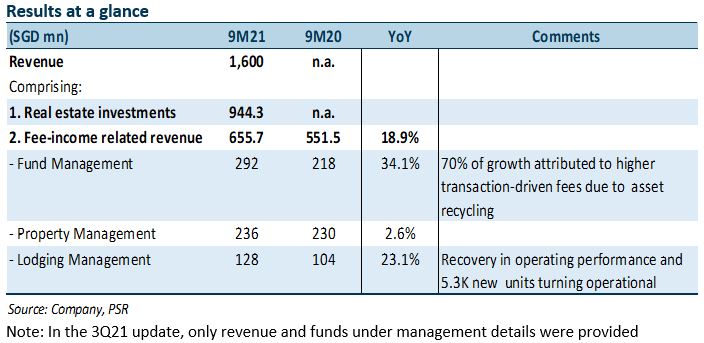

- 9M21 revenue of S$1.6bn was in line, forming 74.3% of FY21e estimates.

- Active capital recycling and inception of S$1.4bn in funds year-to-September grew 9M21 fund management fee-related earnings (+34%) and funds under management (+9%).

- Lodging and retail recovering steadily, office and new economy resilient.

- Maintain ACCUMULATE and SOTP derived TP of S$4.00, representing an 18.9% upside. CLI is trading at 16.7x P/E; we are forecasting FY21e dividend yield of 2.4%. Growth drivers for CLI include growth in FUM and keys signed, and c.43% of signed lodging units turning operational.

The Positives

+ Active capital recycling, driving 9M21 fund management fee-related earnings (+34%) and funds under management (+9%). CLI divested S$12.3bn as at 10M21, 4x higher than the S$3.0bn in FY20. Assets were divested at an average of 13.5% above fair value, higher than the 10-11% premium CLI has achieved in the last 3-5 years. Capital recycling also allowed CLI to rebalance its portfolio into new economy assets. c.78% of assets divested were integrated development assets such as the Raffles City projects in China, while 69% of S$5.3bn in total investment were in new economic assets, which include data centres, business parks and logistics assets. CLI incepted seven new private funds in 9M21, five of which were incepted in 3Q21, raising more than S$1.4bn from external parties. New investments and inception of funds grew funds under management (FUM) by 9% since Dec21, from S$77.6bn to S$84.3bn. 9M21 fund management fee-related earnings grew by S$74.2mn or 34% YoY; 70% of the growth attributed to higher transaction-driven fees due to asset recycling.

+ Lodging segment recovering steadily, office and new economy resilient. 3Q21 RevPAU up 12%/33% QoQ/YoY; occupancy improved YoY from 50% to 60%. The recovery in operations, together with 5,300 units (4.1% of signed units) turning operational, resulted in a 23.1% YoY growth in lodging fee income for 9M21. Occupancy for the office and new economy sectors has been resilient, remaining above 90% on average.

The Negatives

– Malaysia retail lagging recovery, having been under strict movement control for most of 2021. While tenant sales in Singapore and China have recovered 13.8% and 14.3% YoY for 9M21, tenant sales in Malaysia declined 15.0%. Occupancy at Malaysian malls has fallen c.10ppts to 84.3% (FY19: 94.3%). This compares to the 96.4% and 93.9% retail occupancy for Singapore and China.

Outlook

Balance sheet heavy, but critical for growing FUM. CLI is relatively balance sheet heavy compared to other REIMs. Its net debt-to-equity ratio of 0.49x is higher than that of its peers, which range 0.25-0.3x. However, having a larger balance sheet is critical for CLI as it is trying to grow its private fund business. It allows CLI to pick up assets opportunistically, incubating and using them to seed new funds, thereby growing FUM. As CLI’s private fund business is less established compared to its track record as a manager of listed funds, CLI is prepared to take up to 20% stake in newly incepted private funds as a show of confidence and alignment of interest with its third-party equity providers. CLI is on track to reaching its 2024 FUM target of S$100bn.

CLI’s property portfolio continues to recover on the back of a reopening and return-to-normalcy. The investment management and lodging platform enjoys growing demand from private capital and lodging owners. The divestment of partial stakes in six Raffles City China assets to China Ping An has triggered reverse enquiries from several Chinese investors looking to create permanent investment vehicles. The stars are aligning for CLI, which secured its private equity fund manager status in China for RMB capital raising, a previously untapped capital market for CLI.

Maintain ACCUMULATE and SOTP TP of S$4.00

No change in our estimates. Our SOTP derived TP of S$4.00 represents an upside of 18.9%. CLI is trading at 16.7x P/E; we are forecasting FY21e dividend yield of 2.4%.

Source: Phillip Capital Research - 8 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024