United Overseas Bank-Limited Stable Recovery

traderhub8

Publish date: Fri, 05 Nov 2021, 05:25 PM

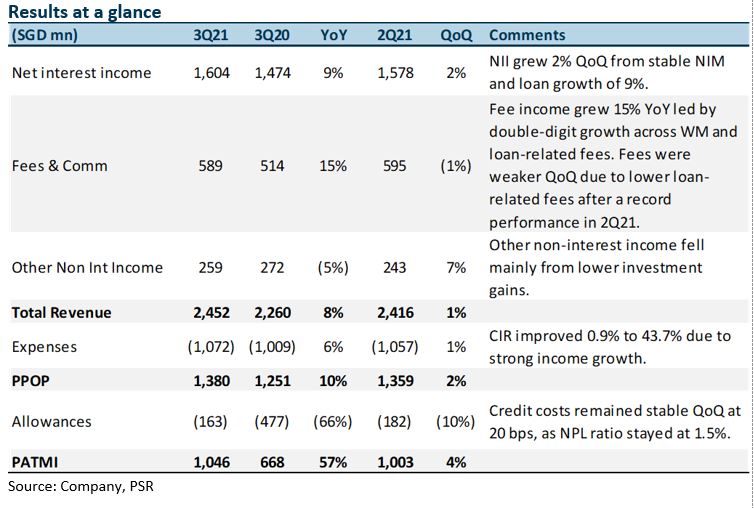

- 3Q21 earnings of S$1.05bn in line with our estimate. 9M21 PATMI is 73% of our FY21e forecast.

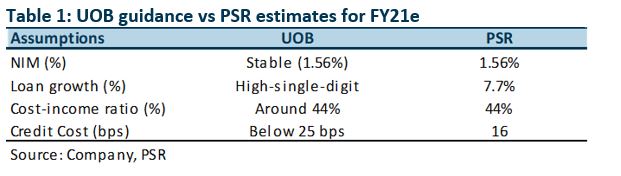

- NIMs eased 1bp QoQ to 1.55%, though NII grew 2% in the same period. Guidance of stable NIM for FY21e unchanged. Impairment provisions of 20bps below our forecast of 30bps in FY21e credit cost.

- Maintain ACCUMULATE with unchanged target price of S$29.00. Our FY21e estimates unchanged. Recovery path for UOB is on track. Potential upside surprise includes GP writebacks and special dividends.

The Positives

+ NII increased 2% QoQ, led by steady loan growth. Loans grew 3%, underpinned by large corporate loans. NIMs, however, eased 1bp this quarter to 1.55%. Excess liquidity has driven up competition for higher quality loans especially in the FIG (Financial Institutions Group) space. However, lower NIMs offset by fee income and thereby more attractive return on risk weighted assets.

+ Fee income grew 15% YoY. Fee and commission income grew 15% YoY, particularly from wealth and loan-related fees as investment and trade activities pick up. Fees, however, were 1% weaker QoQ as loan-related fees moderated after a record 2Q21.

+ Impairment provisions below our base case of 30bps in FY21e credit cost. Allowances were stable at 20bp. Allowances at S$163mn in 3Q21 vs. S$182mn in 2Q21. The QoQ drop reflected overall resilient asset quality and strong pre-emptive general allowances taken previously. Total general allowance for loans, including RLARs, were prudently maintained at 1% of performing loans.

The Negatives

– Loans under moratorium lowered to 4.8%. We believe these belonged to weaker corporates which still require loan relief. As the moratoriums begin to expire, we could see an uptick in NPLs in the remainder of FY21e. With the Malaysian government announcement of a blanket six-month moratorium until early 2022, the management expects an increase in NPLs among consumers and SMEs in Malaysia, with management expecting an uptick in the NPL ratio to about 1.7-1.8%. Around mid-20% of Malaysia loans are under loan relief (or S$7bn) and management has estimated the impact of the interest waiver scheme in Malaysia to be marginal at less than S$10mn.

Outlook

PATMI: UOB’s profit should recover in 2022 on the back of stabilising margins, stronger fees and lower provisions. We expect WM, loan-related and card fees to expand 22% YoY. We continue to expect credit costs to come in below guidance of 25bps. There is earnings upside from writebacks of the S$1bn in management overlay of general provisions. A condition to writeback will be the outlook of the pandemic. General provisions is expected to trend at 80 to 90 basis points of gross loans. This implies around S$450mn of writebacks.

China: UOB’s exposure to Mainland China remains at 6% of total assets, with bank exposure at S$10.7bn and non-bank exposure at S$11.9bn. Nonetheless, customers include mainly domestic and policy banks, top-tier SOEs, large local corporates and foreign investment enterprises. NPL ratio for non-bank Mainland China loans stable at 0.3%.

NIMs: Management only expects improvement in NIMs in the later part of 2022. Asset quality is expected to stabilise and management expects to continue to see strong demand for loans as cross border activities pick up. ASEAN loans growth are expected to be higher with some slowdown in Singapore and North Asia. Growth so far has been skewed towards the developed markets as the ASEAN economy remains muted, but management expects this to change in 2022 as the economy recovers.

Investment Action

Maintain ACCUMULATE with unchanged target price of S$29.00

We maintain our ACCUMULATE recommendation with an unchanged GGM target price of S$29.00. We are keeping our FY21e forecast unchanged. Our target price remains based on GGM (1.17x FY21e P/BV) valuation.

Source: Phillip Capital Research - 5 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024