Sheng Siong Group Ltd – Market Share Spike

traderhub8

Publish date: Mon, 01 Nov 2021, 11:09 AM

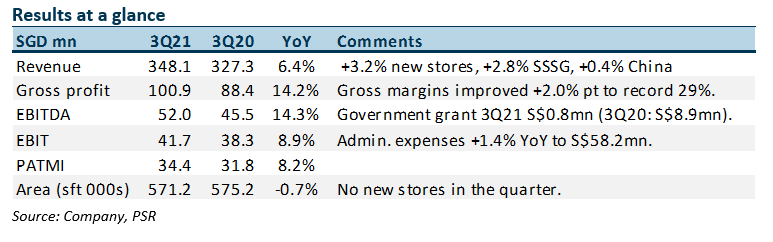

- 3Q21 revenue and PATMI beat our estimates. 9M21 revenue and PATMI at 85%/91% of forecasts. Gross margins was a record 29%.

- The closure of Jurong Fishery port and Pasir Panjang wholesale centre resulted in a surge in fresh food sales. Cautious consumers in visiting wet markets was another trigger.

- We raised FY21e PATMI by 15% to S$126.9mn. FY21e revenue forecast is lifted 11% and gross margins increased by 0.5% points to 28.3%. Our FY22e forecast is unchanged. The recent spike in cases is accelerating Sheng Siong’s market share in fresh food from wet markets. We believe this is a secular trend. Our target price is unchanged at S$1.69, based 5-year historical average of 25x PE. The target price is based on FY22e earnings, to reflect more normalised earnings as borders re-open. Upgrade to BUY from ACCUMULATE due to recent weakness in share price.

The Positive

+ Another record in gross margins. Gross margins touched a record 29% in 3Q21. Driving up margins was the higher contribution of fresh products. Closure of Jurong Fishery port and Pasir Panjang wholesale centre shrunk fresh food supply in wet markets driving up demand in SSG stores. Worries on the rising cases and wet market setting led to households preference to source fresh food in supermarkets. SSG avoided the fresh food disruption by sourcing more fresh food directly from suppliers.

The Negative

– No new stores this year. SSG has not secured any new stores this year. There are plans for six new stores to be bid out by HDB in 2022. The recent relaxation of foreign workers may aid in the faster build-out of HDB units and quicken the timeline in bidding out new supermarkets.

Outlook

Lack of new store openings this year will dampen sales growth in FY22e. However, SSG competitive edge in managing their fresh food supply chain can elevate gross margins higher than pre-pandemic levels. Ability to source directly and diversely, scale in procurement and frequent refreshing and delivery of inventory, are some of the competitive edge SSG enjoys in fresh food. We believe the secular trend to shop in supermarkets away from wet markets has accelerated due to the pandemic. Rising prices in the current inflationary period may be beneficial for SSG due to its reputation as the cheapest grocery chain.

Upgrade to BUY from ACCUMULATE with unchanged TP of S$1.69

SSG enjoys attractive ROEs of 25%, dividend yields at 3.2% and net cash at S$215mn (as at Sep2021). Uncertainty over normalised earnings post-pandemic and lack of new stores are some of the near-term headwinds for the share price.

Source: Phillip Capital Research - 1 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024