Del Monte Pacific Limited – Turnaround Underway

traderhub8

Publish date: Mon, 25 Oct 2021, 10:37 AM

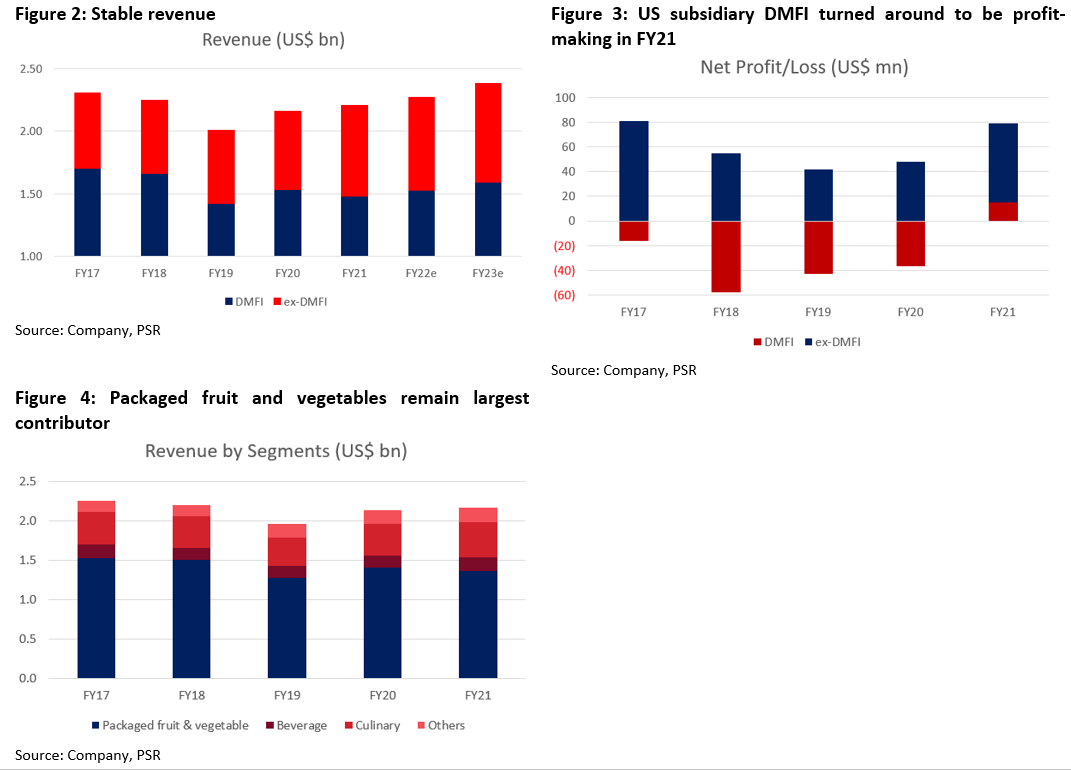

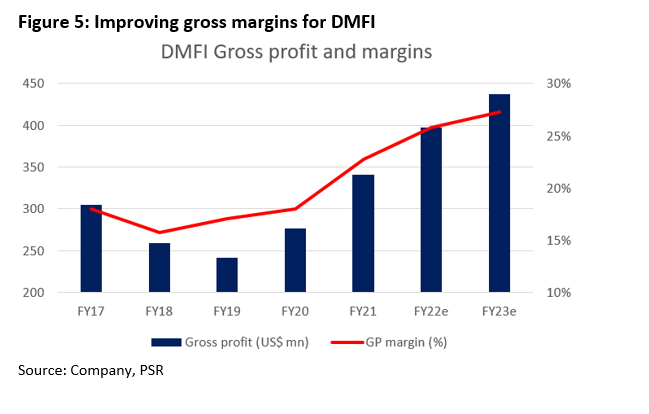

- US subsidiary Del Monte Foods Inc. (DMFI) turned profitable in FY21. It had been suffering losses since the acquisition in 2014. Loss-making factories were closed, low margin products exited, new products introduced and more distribution channels were established.

- Del Monte Philippines Inc. (DMPI) enjoys dominant market shares as high as 90% in the Philippines. Growth is expected from a new dairy product line, expanding distribution points and exports of fresh pineapples into China.

- Initiate coverage with BUY and TP of S$0.60. DMPL is currently trading at 8.2x FY22e, below the industry average of 16x. We apply a 20% discount to industry valuation due to comparatively higher leverage. Stock catalysts expected from turnaround of DMFI and stable growth of DMPI in the Philippines. We peg DMPL to 13x FY22e P/E.

Company Background

Dual-listed on the Singapore Exchange and Philippine Stock Exchange, Del Monte Pacific Limited (DMPL) produces and markets packaged vegetable and fruit, beverage and culinary products (refer to Appendix 1).

In the US, DMFI is ranked first in canned vegetables and second in canned fruits, as consumers continue to turn to trusted brand names for meal preparation and healthy snacks. DMPI’s dominant market shares in the Philippines of as high as 90% in key categories have continued to rise. Retailers are carrying fewer brands and focused on the largest.

Investment Merits

- Turnaround of the US business. DMFI was acquired in February 2014 for US$1.7bn. In FY21, DMFI generated a net profit of US$15.8mn, reversing years of operating losses. The path to profitability was from the closure of loss-making factories, exit of low margin private label products, new product innovation, raising prices and penetrating new distribution channels including food services. We expect the continuing introduction of new products and margin expansion to contribute to gross profit growth at CAGR of 13% over next two years. New products launched in the past three years accounted for 6% of FY21 revenue.

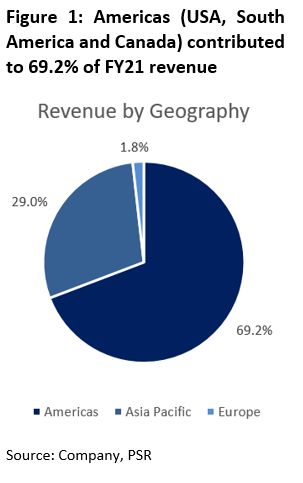

- Del Monte’s dominant market share in the Philippines is expected to continue driving sales. DMPI is DMPL’s most profitable subsidiary, generating a record net profit of US$94.5mn in FY21, up 40%. Primarily present in the Philippines, the Asia Pacific segment made up 29% of FY21 revenue, but 49% of operating income. DMPI entered into a joint venture with Vinamilk, the largest dairy manufacturer in Vietnam to expand into the dairy sector in the Philippines. The JV will import dairy products from Vinamilk under four product lines and distribute them in the Philippines. DMPI products are available across the Philippines in more than 100,000 stores. There are plans to raise this to 200,000 stores in five years.

Significant undervaluation of DMPL. DMPL is trading at FY22e P/E of 8.2x, far below the industry average of 16x. The company had been underperforming since the acquisition of US subsidiary DMFI in 2014. Over the years, the new management has turned DMFI around successfully, steering towards innovation to address shifting consumer habits and expanding distribution into key growth areas. We believe another reason for the undervaluation is the debt level of US$1.3bn, resulting in high interest expenses of US$111mn, which we expect to wind down gradually. We apply a 20% discount to the industry average, due to its gearing level which is higher than peers and smaller market capitalization.

REVENUE

Del Monte Foods Inc (DMFI). DMFI is Del Monte’s US subsidiary, under which they have both branded and private retail sales. This segment was acquired in 2014 and is mainly present in the US. It has been accounting for the bulk of DMPL’s revenue, and made up 70% of FY21 revenue, driven by branded retail sales (Figure 2). The majority of sales under the Americas segment are sold under the Del Monte brand but also include products under the Contadina, S&W, College Inn and other brands. This segment also includes sales of private label food products. Sales are distributed in all channels serving retail markets, and to certain export markets, the food services industry and other food processors.

Del Monte Philippines Inc (DMPI). This is DMPL’s second-largest and most profitable subsidiary. In the Philippines, sales are derived from general trade, modern trade and food services. General trade (GT) includes retailing to a network of retailers, wholesalers, and dealers. Modern Trade (MT) includes the distribution of goods to supermarket chains. Food services include selling through restaurants. The GT and MT combined grew by 13.4% in FY21, delivering record sales of US$705.8mn.

DMPI products are also exported to Europe and S&W markets. This includes exports of fresh and packaged pineapples. Sales increased from higher sales of fresh pineapples in China, Japan and South Korea, and packaged pineapple, mixed fruit and juice drinks.

EXPENSES

Costs primarily include metal packaging, packaging and raw material costs. DMPL has introduced various cost cutting measures over the years.

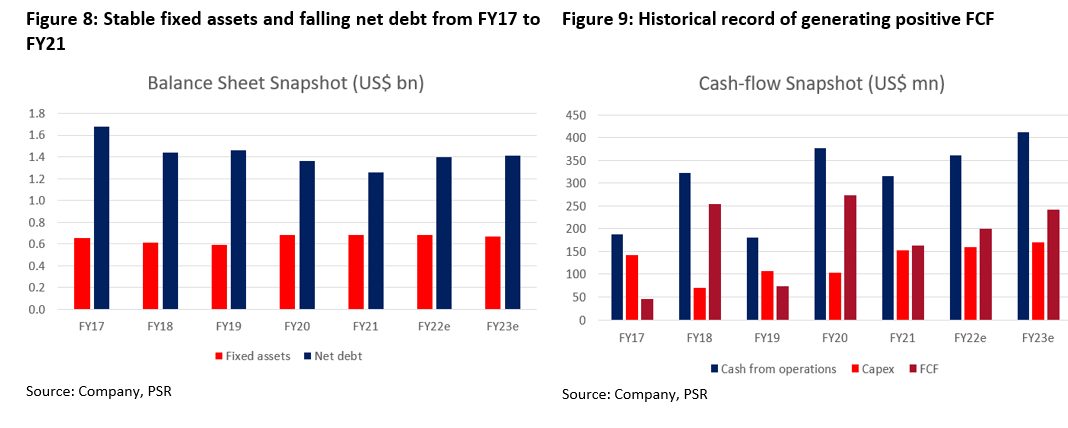

DMPL has high levels of borrowing, with net debt of US$1.3bn in FY21. This also comes with interest burden of US$111mn. The company has progressively reduced net debt over the past five financial years. It may take another three years before reduction of interest expenses to below US$100mn, as we expect repayment of some short-term borrowings.

In 2017, DMPL completed the offering and listing of 20mn Series A-1 and 10mn Series A-2 preference shares, both at an offer price of US$10 per share in the Philippines, at a fixed rate of 6.625% and 6.5% per annum. We have factored in assumptions that Series A-1 and A-2 preference shares would be redeemed by FY22 and FY23 respectively.

MARGINS

DMFI generated a gross profit margin of 22.6% in FY21, up from 17.6% in FY20. This was driven by higher sales from branded retail, combined with lower promotional trade spend and cost improvement including lower cash discounts. There were also lower packing costs from the asset light strategy, with production outsourced. Plant closures in FY20 generated savings, in line with DMPL’s asset-light strategy.

We expect DMFI gross margins to climb further in FY22e and FY23e. Levers to raise margins to include reducing overhead and trade spending, and capacity expansion in packaging. To alleviate recent cost pressures, DMFI raised product prices in May and September this year. We believe the strength of the brand will keep volumes resilient despite the higher prices.

DMPL generated an average gross profit margin of 21.8% over the past five financial years, and EBITDA margin of 13.3%, which we expect to remain stable.

BALANCE SHEET

Assets. Fixed assets have remained largely stable over the past five financial years from FY17 to FY21, at US$680mn. DMPL has adopted IFRS 16 since 1 May 2019.

Intangible assets and goodwill is the biggest component of DMPL’s assets, consisting of trademarks, including the right to use the “Del Monte” trademarks in connection with the production, manufacturing, sales and distribution of food products, in various markets (Figure 6).

As of 30 April 2021, DMPL carries goodwill of US$203.4mn and indefinite life trademarks of US$408mn, with US$394mn relating to DMFI.

Liabilities. DMPL has been gradually reducing its net debt, to US$1.3bn in FY21 (Figure 8), and gearing was lowered from 2.4x to 2.0x equity.

DMPL issued US$500mn of 11.875% Senior Secured Notes on 15 May 2020. They will mature on 15 May 2025 and are redeemable at the option of DMPL beginning in May 2022. The Notes make up 50.4% of total non-current liabilities (Figure 7). Interest paid under this loan in FY21 was US$29.7mn, accounting for 27% of total interest expense.

Recently, S&P Global Ratings raised credit rating on DMFI to ‘B’ from ‘B-‘, and issue-level rating on its debt to ‘B’ from ‘B-‘. This is on the back of continued deleveraging, with 11% revenue growth and high profitability in 1QFY22, with EBIT margin of 9.3%. This resulted in improvement in leverage from 10x to about 3.5x for 12 months ending 1 August 2021.

Cash flow. DMPL has been generating positive operating and free cash flows from FY17 to FY21. Operating cash flow was lower in FY21 due to higher working capital. Capex has remained relatively stable at an average of US$115mn over the past five financial years (Figure 9).

While they do not have a fixed dividend policy, DMPL paid out 37% of PATMI in FY21, and 50% of PATMI in FY19. FY20 was a loss-incurring financial year due to plant closures resulting in one-off expenses, so only preferred dividends were paid.

INVESTMENT MERITS

- Turnaround of the US business. DMFI was acquired in February 2014 for US$1.7bn. In FY21, DMFI generated a net profit of US$15.8mn, reversing years of operating losses. The path to profitability was from the closure of loss-making factories, exit of low margin private label products, new product innovation, raising prices and penetrating new distribution channels including food services. We expect the continuing introduction of new products and margin expansion to contribute to gross profit growth at CAGR of 13% over next two years. New products launched in the past three years accounted for 6% of FY21 revenue.

- Del Monte’s dominant market share in the Philippines is expected to continue driving sales. DMPI is DMPL’s most profitable subsidiary, generating a record net profit of US$94.5mn in FY21, up 40%. Primarily present in the Philippines, the Asia Pacific segment made up 29% of FY21 revenue, but 49% of operating income. DMPI entered into a joint venture with Vinamilk, the largest dairy manufacturer in Vietnam to expand into the dairy sector in the Philippines. The JV will import dairy products from Vinamilk under four product lines and distribute them in the Philippines. DMPI products are available across the Philippines in more than 100,000 stores. There are plans to raise this to 200,000 stores in five years.

- Significant undervaluation of DMPL. DMPL is trading at FY22e P/E of 8.2x, far below the industry average of 16x. The company had been underperforming since the acquisition of US subsidiary DMFI in 2014. Over the years, the new management has turned DMFI around successfully, steering towards innovation to address shifting consumer habits and expanding distribution into key growth areas. We believe another reason for the undervaluation is the debt level of US$1.3bn, resulting in high interest expenses of US$111mn, which we expect to wind down gradually. We apply a 20% discount to the industry average, due to its gearing level which is higher than peers and smaller market capitalization.

KEY RISKS

- Increased raw material costs. Costs have gone up in various segments, including tin plating, packaging, shipments, which impact the bottom line directly. DMPL emphasizes an asset-light strategy, including outsourcing production of certain goods and reduction of fixed production costs. Through capacity expansion and price raises, the company has managed to alleviate the effect through higher prices.

- High finance costs. DMPL has high levels of borrowing, with net debt of US$1.3bn in FY21. This also comes with an interest burden of US$111mn. The company has progressively reduced net debt over the past five financial years. It may take another three years before reduction of interest expenses to below US$100mn, as we expect repayment of some short-term borrowings.

- Exchange rate risks. DMPL’s businesses are transacted in various currencies. Currencies contributing to this risk are primarily the Philippine Peso and Mexican Peso. DMPL manages its exposure to fluctuations in foreign currency exchange rates by entering into forward contracts to cover a portion of its projected expenditures paid in foreign currency and accounts for these contracts as cash flow hedges. According to the sensitivity analysis, a 10% strengthening or weakening of the USD against the Philippine Peso in FY21 would have increased or decreased profit before taxation by US$12mn, which represents an 11.6% change. YTD Oct21, the USD has appreciated 5.8% relative to the Philippine Peso.

Source: Phillip Capital Research - 25 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024