CapitaLand Investment Limited – Charting New Growth

traderhub8

Publish date: Mon, 18 Oct 2021, 07:55 PM

- Stable and recurring revenues from fees income and real estate investment contributing c.20% and c.80% to EBITDA respectively.

- Growth in fund management and lodging AUM to drive fee income while capital recycling and new economy assets remain in focus.

- Initiate coverage on CLI with an ACCUMULATE rating and SOTP derived TP of S$4.00, representing an 19.6% upside from current market price. CLI is trading at 16.0x P/E; we are forecasting FY21e dividend yield of 2.4%.

Investment Thesis

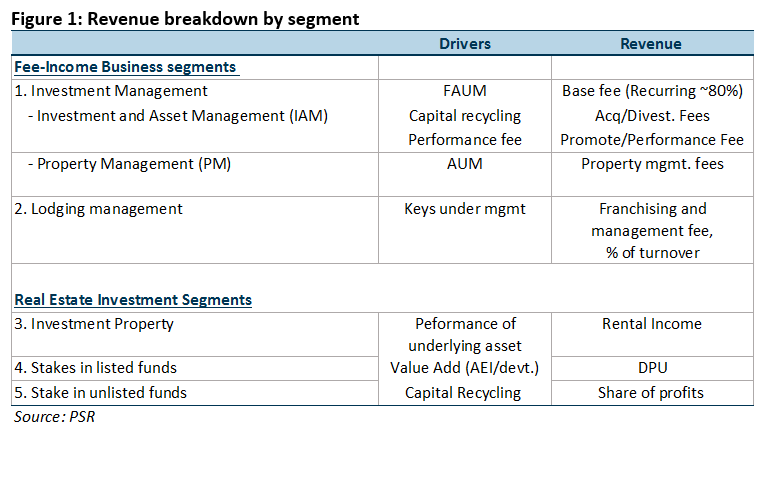

- Stable and recurring revenues from fees income and real estate investments (Figure 1). These segments contribute c.20% and c.80% of EBITDA respectively. Approximately 80% of fee income from the fund management is recurring in nature while the lodging platform generates franchising and management fees from predominantly 3rd party-owned assets. Income generating assets held by CLI is also expected to deliver highly visible cashflows.

- Growth in fund management and lodging AUM to drive fee income. CLI has made great headway towards hitting its 2024 funds under management (FAUM) target of S$100bn. Two new senior hires, Mr Simon Treacy and Mr Patrick Boocock, have been brought on to spearhead the growth of private funds. The lodging platform also on track to surpass its 2023 target of 160K keys under management. CLI signed 8.3K keys in 8M21, bringing the number of keys to 130.9K, of which, c.40% are still under development and have not begun contributing to revenue.

- Divestment targets channelled into new economy sectors. CLI remains committed to its S$3bn divestment target, which will help replenish dry powder to be reinvested into new economy assets such as logistics, data centres, business parks, as well as lodging assets like PBSA and multifamily assets which provide stable returns. This helps to better diversify and keep the portfolio future ready.

Segmental Breakdown

CLI’s revenue is categorised into fee-income and real estate investment.

- Investment Management

FAUM has grown at 5-year CARG of 11% (Figure 2), largely attributed to the growth in listed funds AUM and the acquisition of Ascendas-Singbridge. CLI is still S$17bn shy of its 2024 FAUM target of S$100bn. Going forward, CLI hopes to capture private capital demand for real estate products via its private funds. CLI has brought on two new senior hires to spearhead the growth in private funds.

- Mr Simon Treacy has been appointed as CEO of Private Equity Real Estate. Formerly the CIO of Global Real Estate at Blackrock and CEO of Macquarie Global Property Advisors, Mr Treacy brings with him more than 23 years of real estate experience.

- Mr Patrick Boocock will join CLI as the CEO of Private Equity Alternative Assets, bringing with him more than 20 years of investment management experience. Previously the Managing Partner and Head of Asia at Brookfield Asset Management, Mr Boocock’s expertise in alternative assets spans real estate, infrastructure, renewable energy and private equity.

In June 2021, CLI obtained its registered Private Equity Fund Manager status in China, which will allow it to carry out RMB-denominated capital raising. The group aims to launch its first RMB-denominated fund product in 4Q21. CLI launched two funds YTD; a S$400mn CapitaLand India Logistics Fund II in May21 and its second Korea Data Centre Fund in Jun21 raising S$400mn from third party investors.

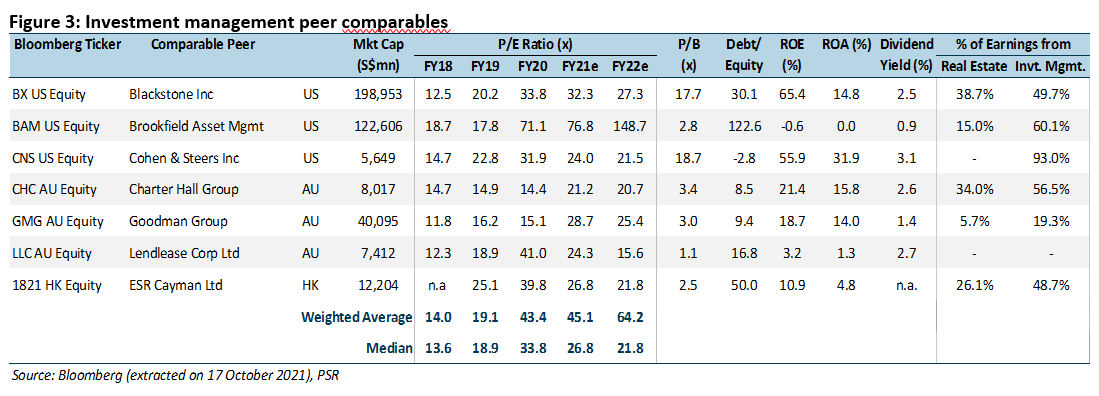

We value the fund management business using the P/E given the stability of fee income, applying a 16x P/E multiple, the average amongst comaprable real estate investment manager peers, which have traded between 12.3x-25.1x P/E pre-pandemic.

- Lodging Management

The Ascott Limited (TAL) is a global, long-stay lodging operating platform with an asset-light model. Of its 128,500 keys under management, 80% are managed units owned by third parties. Brands under TAL include Ascott, Citadines, Somerset, Quest and Lyf, which operate mainly longer-stay, serviced residence, business hotels and co-living assets. Over the past three years, TAL has expanded into adjacent sectors such as the purpose-built student accommodation (PBSA) and multifamily/rental housing asset classes. The clientele for these assets have a longer average length-of-stay between 3-24 months. The investment proposition of long-stay asset classes was tested and validated during the pandemic – SRs outperformed their hotels peers while the multifamily and PBSAs maintained occupancies above 95%.

On track to hit 160,000 keys target by 2023. TAL has been growing the number of keys signed at a 5-year CAGR of 24%. Despite the pandemic, a record 14,000 keys were signed in FY20. FY21’s signings are likely to keep pace with FY20’s numbers – TAL signed 8,300 keys year-to-July, representing a 40% YoY growth in new signings compared to the same period in FY20. TAL will need to grow the number of keys signed at a CAGR of 8.2% p.a., or c.12,500 keys/year, to hit meet its 160,000 keys target.

Unrealised earning potential. Of its 128,500 keys signed, c.47% are still under development and have not begun contributing to revenue. The management expects to reap S$20-25mn per 10,000 stabilised units. We expect fee income to grow at a 5-year CAGR of 16%, on the back of hospitality recovery and more units turning operational.

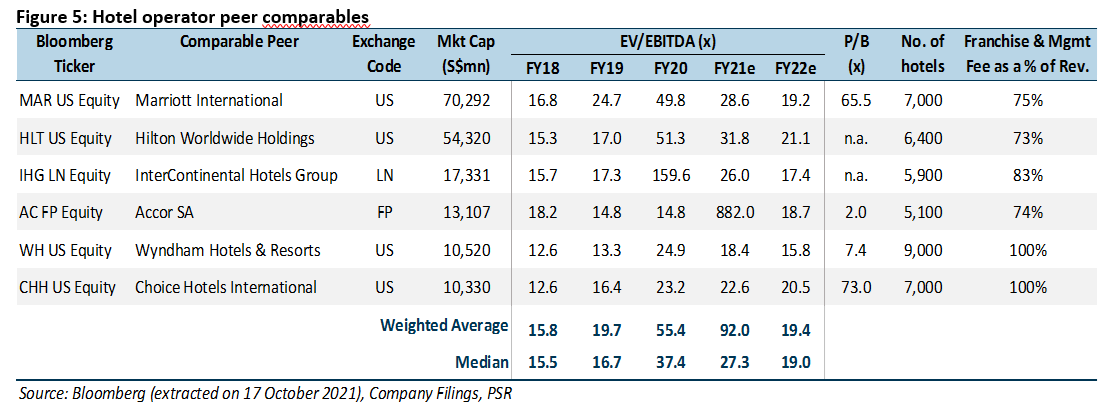

Due to the varied geographical portfolios of its comparable peers, we elected to use the EV/EBITDA multiple as a tax-neutral valuation method for the lodging segment. Comaprable lodging operator peers have traded between 12.6x-24.7x EV/EBITDA. As such, we applied an average EV/EBITDA ratio of 16x for our valuation of the lodging platform.

- Investment Property

CLI holds stablised office, retail, industrial, hospitality and mixed-use assets on its books and through associates and joint ventures. These assets provide recurring rental income for CLI and are expected to be monetised over the next 3-4years to CLI’s REITs, private funds or third-party buyers.

- Stake in Listed Funds

CLI manages six listed funds with equity stakes varying between 18.0%-40.7%, receiving distributions based on the number of units owned. We value this segment using PSR’s and consensus target prices of the respective REITS.

- Stake in Unlisted Funds

CLI manages more than 20 private funds including Core and Core Plus, Value Add, Opportunistic and Alternative funds. Value Add and Opportunistic funds are expected to deliver higher return and represent c.90% of the funds managed. The remaining c.10% are Core and Core Plus funds which invest in stabilised assets. The group maintains a between 6.5%-55.0% stake in the funds. We value this segment based on the RNAV of CLI’s respective stakes in the funds.

Outlook

CLI’s property portfolio continues recovers on the back of a reopening and return-to-normalcy, while its investment management and lodging platform continues to receive growing demand from private capital and lodging owners. The group remains committed to its S$3bn divestment target – monetising its balance sheet and rebalancing into new economy assets to keep its portfolio future ready.

Initiate with ACCUMULATE; SOTP TP of S$4.00

We adopt a sum-of-the-parts (SOTP) valuation for CLI post restructuring. Our SOTP derived TP of S$4.00 represents an upside of 19.6% from current market price. CLI is trading at 16.0x P/E; we are forecasting FY21e dividend yield of 2.4%.

Source: Phillip Capital Research - 18 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024