Singapore Banking Monthly – Outlook Stable

traderhub8

Publish date: Thu, 07 Oct 2021, 03:09 PM

- September interest rates remain flat MoM. Bank exposure to China is less than 14% of total loans. We believe customers are primarily SOE and large overseas corporates.

- Hong Kong’s domestic loans growth fell 2.68% YoY in July.

- Malaysia’s domestic loans growth saw its lowest increase of 3.14% YoY in July and grew 0.12% MoM in July.

- Maintain OVERWEIGHT. We prefer DBS (DBS SP, ACCUMULATE, TP: S$32.00) for its leverage to rising interest rates and improvement in economic conditions.

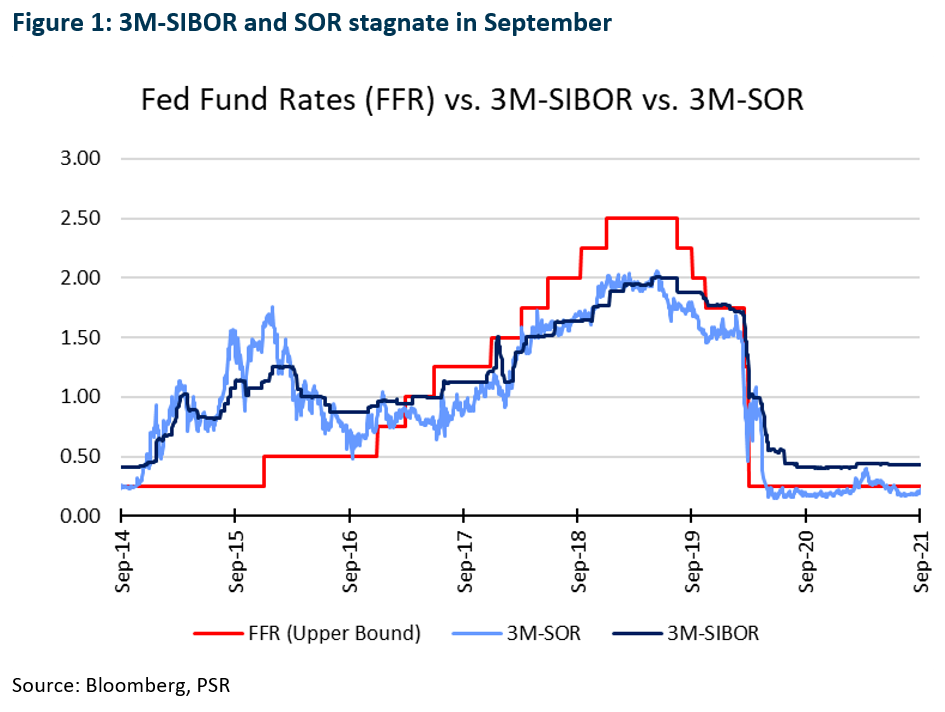

Local interest rates flat in September

Interest rates were flat in September, with 3M-SIBOR flat at 0.43% MoM and 3M-SOR up 2bps to 0.21% MoM. 3M-SIBOR is currently 1bps lower than its 2Q21 average of 0.44%. 3M-SOR is 7bps lower than its 2Q21 average of 0.28% (Figure 1).

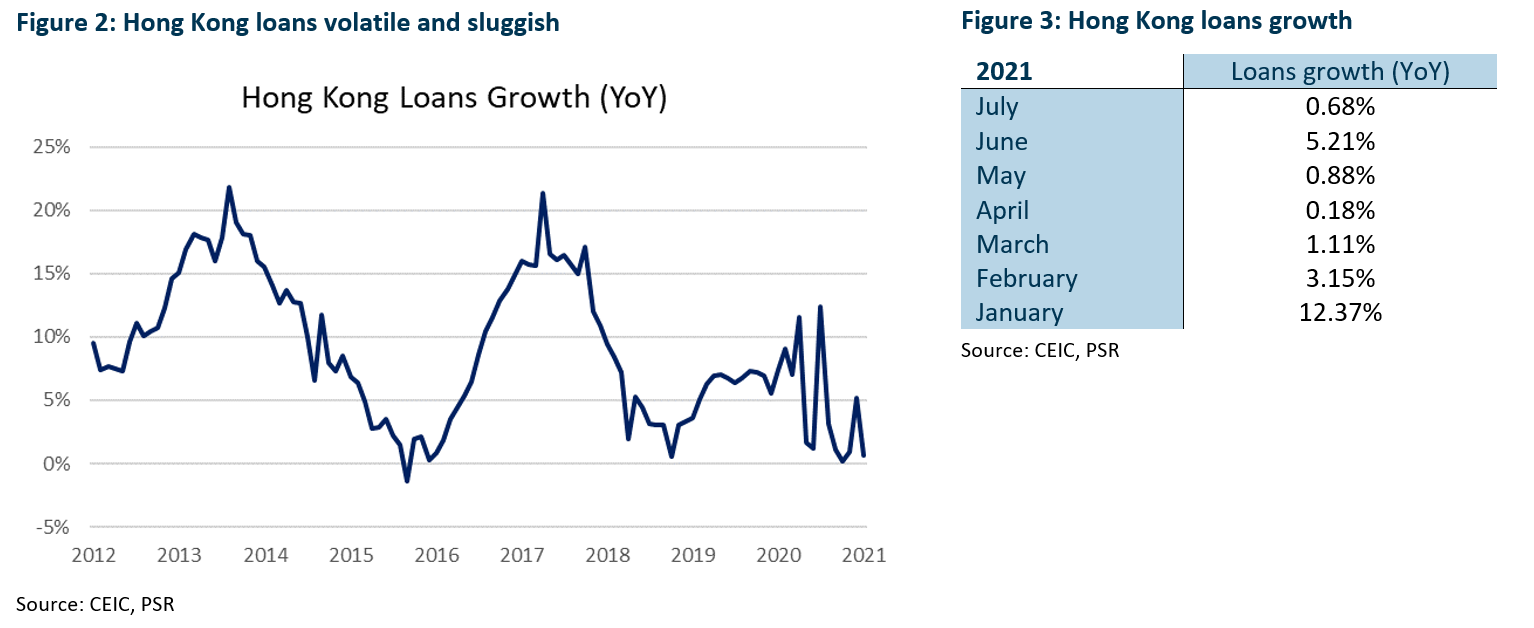

Hong Kong and Malaysia loans stagnate

Hong Kong’s domestic loans growth grew 0.68% YoY and fell 2.68% MoM in July. It recorded the largest drop MoM in July since February 2021. Nonetheless, three government-backed borrowing schemes have been extended by 6 months to further support companies and individuals affected by the COVID-19 pandemic.

They are the SME Financing Guarantee Scheme which will be extended till June 2022, the Preapproved Principal Payment Holiday scheme which will be extended till April 2022, and the Special 100% Loan Guarantee scheme which will be extended till April 2022. The three schemes have granted a total of HK$170bil in loans.

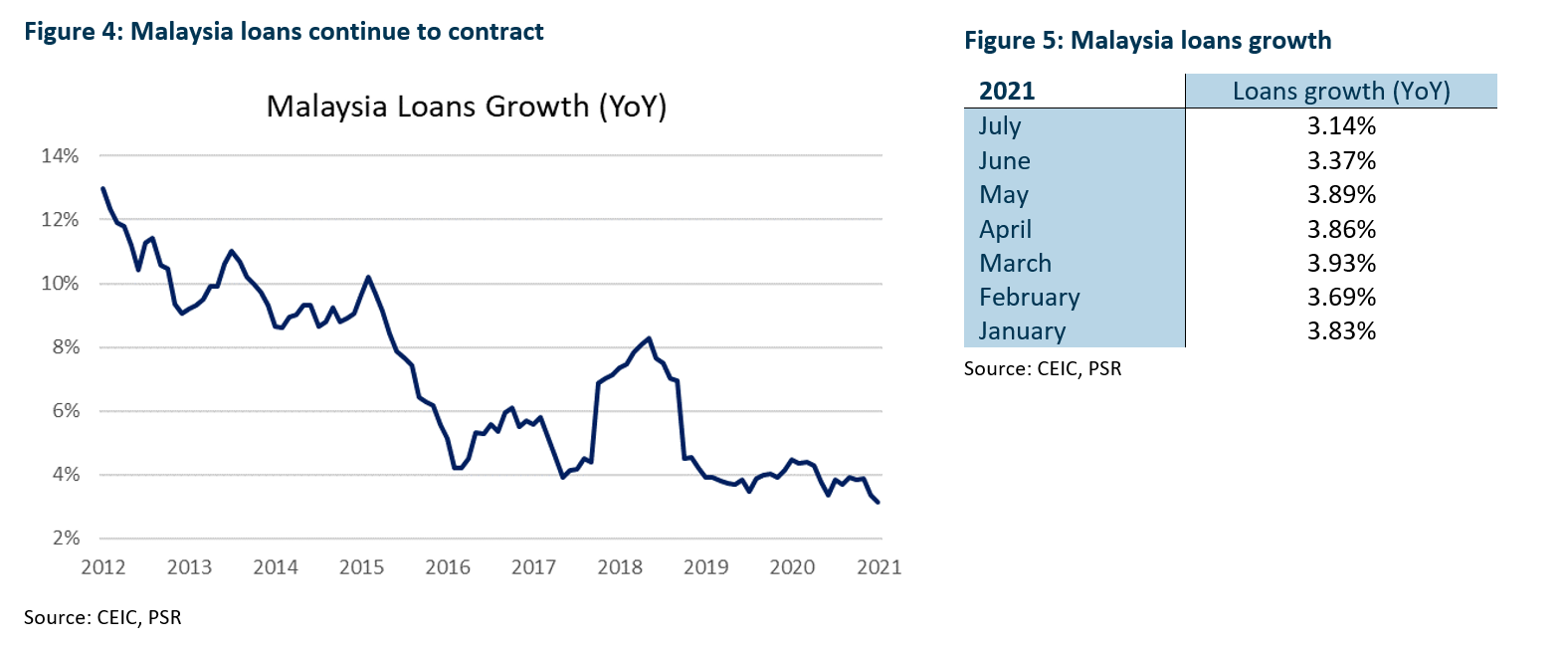

Malaysia’s domestic loans growth saw its lowest increase of 3.14% YoY in July and grew 0.12% MoM in July. This was mainly due to the wave of COVID-19 cases resulting in further lockdowns which delayed business recovery for the domestic banking sector. A second six-month loan moratorium was also announced in July for all individuals and SME borrowers for which they would only start making full payments in 2022.

Volatility rose as Singapore exited Phase 2 (Heightened Alert)

Preliminary SDAV for September increased 9% YoY to $1,207mn (Figure 6), as Singapore tightened COVID-19 restrictions and community cases continue to rise. VIX averaged 19.8 in September, up from 17.5 in the previous month as a surge in Covid-19 cases community cases caused it to remain high.

Likewise, the top five equity index futures turnover saw an increase of 3.2% YoY in September to 15.5mn contracts (Figure 8) mainly supported by higher trading volumes of its FTSE China A50 Index Futures and its MSCI Singapore Index Futures. Notably, Nikkei 225 Index Futures increased 71.6% MoM to 1.5mn while FTSE Taiwan Index Futures contracted 5.9% MoM to 1.3mn.

Source: Phillip Capital Research - 7 Oct 2021

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024