KOUFU GROUP LIMITED Partial Recovery

traderhub8

Publish date: Mon, 06 Sep 2021, 04:56 PM

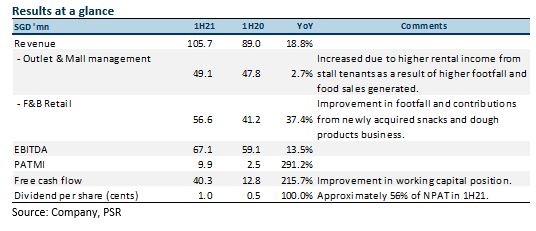

- 1H21 revenue and net profit in-line, at 50.0% and 50.6% of our FY21e estimates.

- Increased takeaway and delivery sales mitigated lower footfall. 1H21 net profit 35% higher HoH despite Singapore’s move into Phase 2 (Heightened Alert).

- Temporary Occupation Permit (TOP) obtained for integrated facility. Operations to progressively commence from 3Q21.

- With safe management measures still in place, footfalls still at 65% of pre-Covid levels.

- Maintain NEUTRAL with unchanged target price of S$0.64. Still based on 18.5x FY21e, the average of its peers as we remain cautious on the pace of the reopening roadmap due to the resurgence of Covid-19 in Singapore and China. Potential re-rating from further relaxation of dine-in measures and increase in foreign travellers to Singapore.

Positives

+ Increased takeaway and delivery sales. 1H21 net profit was 35% higher HoH as increased takeaway and delivery sales mitigated the lower footfall during Singapore’s move into Phase 2 (Heightened Alert) from 16 May to 13 June. Both Dough Culture and R&B Tea were the most resilient due to the nature of its business, and saw increased takeaways and delivery sales.

+ Footfalls improved in Macau, outlook positive. Macau reopened its borders to foreigners via mainland China on 16 March 2021. This led to a slight improvement in footfalls at its malls and food courts during the recent Labour Day holidays in May 2021. All of Koufu’s food courts at the University of Macau, Nova City and Cotai Sands remained operational, though footfall and revenue were about 39% lower than pre-COVID levels. The negative impact was cushioned by rental waivers and rebates from landlords.

+ TOP obtained for integrated facility, operations to begin progressively from 3Q21. The group has obtained TOP in April 2021 for its integrated facility, which is expected to commence operations progressively in the second half of the year. It will be occupying 75% of the total gross floor area with the balance 25% tenanted out. We expect cost synergies from the move to the integrated facility.

+ New outlets secured. The group has secured a food court at Outram Community Hospital and a R&B tea kiosk at Sinopec Petrol Station in Woodlands Ave 5 which is scheduled for opening in 3Q21. It will also be opening a Dough Culture kiosk at Jurong East MRT station and a Grove quick service restaurant at Northshore Plaza to be opened in 4Q21. We expect these to contribute positively to the Group’s revenue stream when they come onboard.

Negatives

– Footfall at 65% of pre-Covid levels. Despite a lifting of dining-in prohibitions at all food outlets, footfall at its outlets has been hurt by the limit of two persons for social gatherings, reduced capacity for malls and work from home as the default mode. Koufu’s food court and Grove quick service restaurant at Singapore Management University and three R&B Tea kiosks at Singapore Management University, Far East Square and Change Alley Mall remain suspended due to low footfalls at these outlets.

Outlook

As Singapore moves into endemic Covid-19, we see a more positive outlook. We expect more measures to be lifted in a calibrated manner, including a further relaxation of limits on dining in. Work from home may also no longer be the default arrangement. We expect improved footfall at Koufu’s outlets as a result.

We also expect cost synergies from FY22e as its supply chain and logistics will be strengthened together with a broadening and expansion of its production capabilities at its new integrated facility. This is expected to lead to higher productivity and product margins. We raise FY22e PATMI by 1% to account for some of these cost-savings. In addition, there will be rental income from the tenancy of nine stalls in a coffee shop, 24 cloud kitchens and 132 beds in the staff dormitory at the integrated facility.

In terms of expansion plans, the group has opened one new food court with one self-operated F&B stall at Sun Plaza, two new R&B tea kiosks at Fusionpolis and Sun Plaza, three Dough Culture kiosks at Sing Post Centre, Sun Plaza and Oasis Terrace in 1H 2021. The Group has further opened 2 new food courts at Marina Square, Nanyang Technological University and 1 new food court shop at the new Koufu Headquarters in Q3 2021. It has also lined up a few new outlets to be progressively opened in 3Q21 and 4Q21.

Macau’s footfall has also improved with an easing of border restrictions. We expect business to improve as more mainland Chinese visit the country under quarantine-free travel arrangements. These are only granted to the most low-risk areas of China at the moment.

Maintain NEUTRAL with unchanged TP of S$0.64

We maintain our NEUTRAL rating and TP of S$0.64, still based on 18.5x FY21e P/E. We remain cautious on the re-opening roadmap due to a resurgence of Covid-19 in Singapore and China. The stock could potentially be re-rated if there is further relaxation of dine-in measures and an increase in foreign travellers to Singapore.

Source: Phillip Capital Research - 6 Sep 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024